Feeling a little contrarian today? Seth Klarman is, and he is buying some beaten down SLM with a full third of his portfolio. . .

The 13Fs are arriving and below I update the two tracking portfolios.

(For background on this approach, check out Show Me Your Hand – Betting on the Smart Money.)

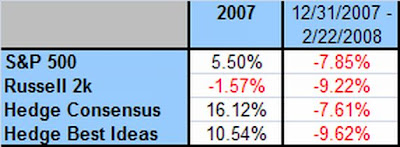

Below is a table of updated performance figures for the two strategies we track, followed by individual fund holdings and commentary. In our previous backtests, we found that the strategies outperformed the stock indexes by 6-12% per year since 2000 with similar volatility. 2007 was the first year out of sample and the performance was quite strong.

A subjective and non-scientific observation is that the portfolios generally track the market on the downside, but have much higher upside volatility.

Performance:

Hedge Fund Consensus – Top holdings owned by 15 value hedge funds, ranked by # of funds with the same position. Google was the worst performer at -27%.

QCOM (5)

AMX (4)

AXP (3)

MA (3)

MSFT (3)

WMT (3)

The list of double repeats is at the end of the post.

Hedge Fund Best Ideas – Top two holdings from each of 10 value hedge funds listed below. Apple was the worst performer at -40%. (Since AMX and QCOM are repeats, I took the next two stocks – SWN and MA.):

AMX

BBBY

CA

CVA

CVS

DISCA

GOOG

HLX

HPQ

KO

MA

MCO

NWS

ORCL

QCOM

ROST

SLM

SWN

TGT

WFC

—-

Baupost Group

Wow. A full third of Klarman’s portfolio is in SLM. When one of the best investors on the planet has this sort conviction, that is good enough for me. Link to a Klarman’s speech at MIT.

Top sectors in the portfolio include:

Financials 57%

Services 12%

Energy 14%

Top 10 holdings are:

SLM

NWS

LINE

HRZ

FAF

APL

UFS

EXH

ELOS

MAQ

Blue Ridge Capital

Sold off a little Discovery Holdings, and doubled positions in Target, Coach, and Starbucks.

Top sectors in the portfolio include:

Services 43%

Financials 18%

Technology 15%

Top 10 holdings are:

CVA

DISCA

SCHW

TV

AMX

LVLT

AXP

WMT

BR

TGT

Warren Buffett

Top 10 holdings are:

KO

WFC

AXP

PG

BNI

KFT

JNJ

WSC

USB

BUD

Eminence Capital

New positions in Lab Corp and Viacom, and added a bit to the largest position Ross Stores.

Top sectors in the portfolio include:

Services 33%

Technology 30%

Financials 12%

Conglomerates 11%

Top 10 holdings are:

ROST

ORCL

PHG

FISV

QCOM

AXP

SAI

AMAT

IGT

CSCO

Greenlight Capital

A big increase in the top position Target, and new positions in Walgreens and Health Management Corp.

Top sectors in the portfolio include:

Services 27%

Financial 17%

Technology 16%

Energy 15%

Capital Goods 12%

Top 10 holdings are:

TGT

HLX

AMP

MSFT

MDC

BAGL

VOV

SAI

MIM

URS

Lone Pine Capital

Beefed up the position in Qualcomm, and initiated positions in Sandridge Energy and Mastercard.

Top sectors in the portfolio include:

Services 34%

Technology 22%

Financials 9%

Basic Materials 8%

Top 10 holdings are:

AMX

QCOM

SWN

GOOG

PCLN

BAM

SLB

COH

FAST

BNI

Maverick Capital

Supposedly had an awful January. But talk about nice timing on that new purchase of $200 million in Yahoo shares. Other than adding some AMD and paring some AAPL, not much has changed.

Top sectors in the portfolio include:

Technology 27%

Services 32%

Financials 13%

Healthcare 13%

Top 10 holdings are:

QCOM

CVS

AMX

TMO

RTN

AAPL

GME

AMD

WU

BK

Okumus Capital

Lost of turnover here. 80% of the portfolio is in the top 4 holdings with BBBY accounting for almost 40%.

Top sectors in the portfolio include:

Services 95%

Top 10 holdings are:

BBBY

MCO

LTD

ODP

MHP

PZZA

ARB

M

CMCSA

HOTT

SHOO

URI

Private Capital

Sold off a bit of the top holdings, but not much.

Top sectors in the portfolio include:

Services 37%

Technology 27%

Financials 26%

Top 10 holdings are:

CA

HPQ

MGM

BEAS

SYMC

NTRS

RCL

BSC

EK

IGT

Tiger Global

New positions in Mastercard, Longtop, Priceline, and Research in Motion.

Top sectors in the portfolio include:

Services 33%

Technology 40%

Financial 11%

Top 10 holdings are:

GOOG

AMX

MA

AMT

BIDU

FMCN

LFT

PCLN

MELI

TDG

List of double repeats:

AMAT

BAM

BBBY

BIDU

BNI

BRK

CME

COH

CSCO

CVC

DGX

EMC

ETFC

EXP

GOOG

HRZ

IGT

M

MCO

MDC

ODP

ORCL

PCLN

SAI

SBAC

SLM

TGT

TMO

TT

TXT

UTX