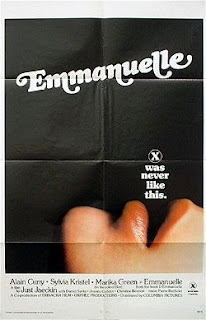

There have been over 30 films based on the Emanuelle franchise, a softcore film series that began in the 1960’s. According to Wikipedia, it remains one of the most successful films in French history. What does this have to do with hedge funds?

Boussard & Gavaudan is a hedge fund listed on the Euronext in Amsterdam. It has the distinction of having two Goldman alums, both with the first name Emmanuel. The fund invests in a feeder fund to the Sark fund (about $4 billion AUM). These strategies include convertible bond arb, volatility arb, gamma trading, merger arb, special situations arb, catalyst driven long/short strategies, capital structure arb, credit long/short, distressed, and value strategies. (No wonder they have over 50 employees.)

Since 2003, the fund has returned about 10% per year with volatility down around 5%. Boussard is trading at about a -15% discount.

Manager: Boussard & Gavaudan Asset Management (BGAM)

Website: www.bgholdingltd.com

Location: London, Paris

Listing: Euronext (Amsterdam)

Symbol: BGHL (Yahoo BGHL.AS)

Fund AUM ($): ~$1.5 billion

Currency share classes: €