Princeton-Newport is one of the best performing hedge funds of all time, and for a good review check out the great book Fortune’s Formula(more in the next post). 15% per year for 20 years and 3 down months is a pretty enviable track record.

Thorp has a chapter in The Best of Wilmott, and you can actually download the PDF for free here: “Models for Beating the Market“.

—-

A couple of housing ETFs are coming to the market:

UMM – MacroShares Major Metro Housing Up

DMM – MacroShares Major Metro Housing Down

—-

Dexion is launching more funds in Europe. None yet in the US.

—-

A new managed futures ETN hits the market (LSC). As I predicted in an earlier article in mid-07, this ETN cuts the fees in half from the Rydex fund (RYMFX) down to 0.75%. Direxion is also launching a mutual fund on the sister version of the DTI, the CTI (which exclusively invests in commodity futures).

—-

Nice blog with a good recent post on Tobin’s Q – Disciplined Investing

—-

Good post from AllAboutAlpha: Hedge funds don’t use that much leverage, and (surprising to me) most managers don’t co-invest in the fund.

—-

A brief history of Old Lane Partners.

—-

I wish I knew this when I was studying Engineering and Biology.

—-

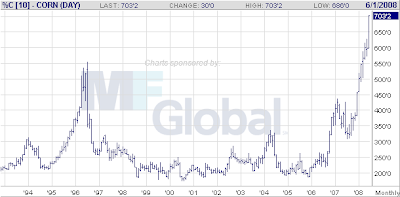

I just finished reading “The Omnivore’s Dilemma” which was pretty good. The book spent a lot of time on corn (which is in everything), and the cheap prices corn was trading for. Not anymore (from Futuresource) :