I’ve written a bunch about mean reversion, most recently in May but also in my book. One strategy is to look for asset classes that were down both two and three years ago (1,2, and 3 years ago is even better). The median return from our study after down years two AND three years ago was 19% (vs ~12.66% for all observations). The median return after three down years in a row was 25.78%!

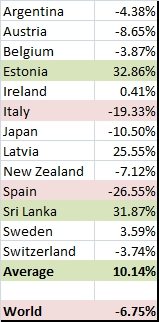

How would a portfolio of countries that were down two and three years ago be doing? Pretty darn good (the world indexes are down around 5-10% depending on which you choose):