I think there is a big need for a newsletter that focuses on public alternative and actively managed funds for the professional (and hobbyist/active individual) investor. Most people have a difficult time making sense of the hundreds of offerings that are coming out on a daily basis in the ETF and mutual fund space. Morningstar has the best research offering I have seen so far, although it is limited to the ETF space (ETF Investor: disclosure – I am a subscriber and our fund GTAA was featured in the last piece.)

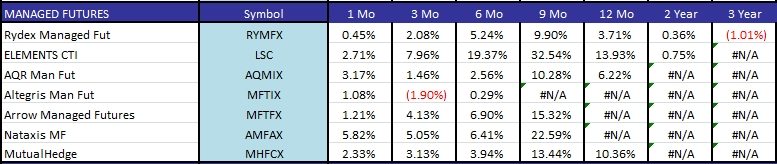

The managed futures space is a good example. It is an area that historically was difficult for most to understand, was/is (ridiculously) expensive, and there have been few public choices available. I mentioned awhile back that my intern built a killer Excel sheet that could update and report performance for any publicly traded list of funds/stocks. I wasn’t quite expecting the overwhelming response for the Excel sheet, but instead of emailing out the Excel sheet (which is a rather complicated install and I don’t want to have to offer software support for the file) we have considered just building it as a website. Stay tuned and we will post updates to the blog when available.

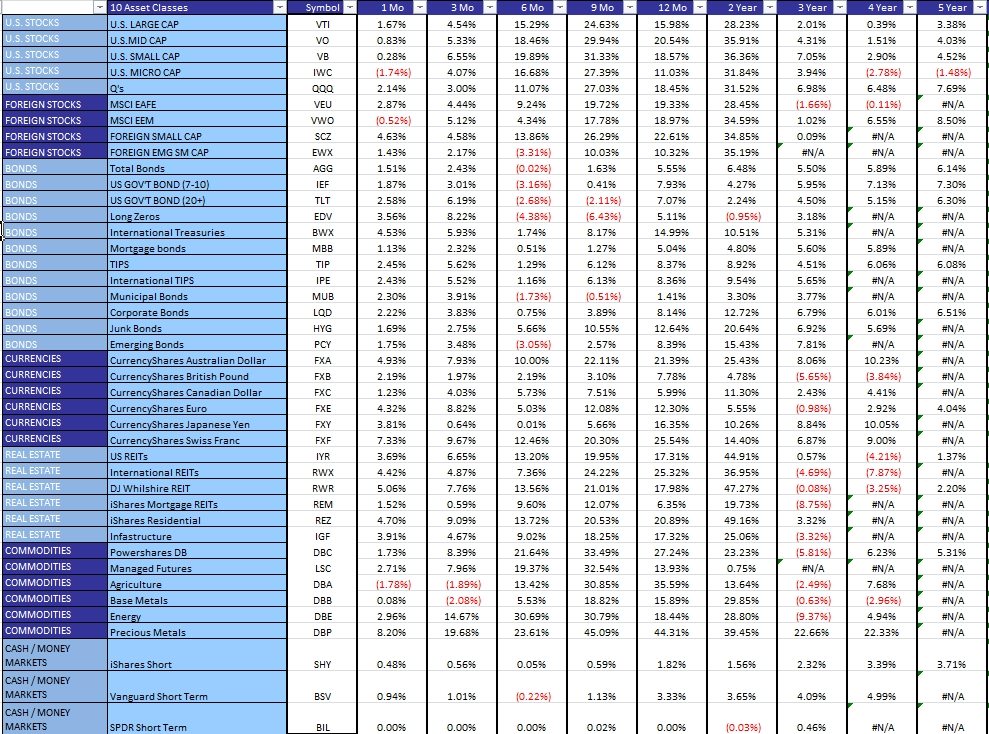

Anyways, here is a look at the various managed futures funds and their performance over the past few periods, as well as performance for some asset classes updated last nite:

(click to enlarge)