Maybe the combination of two seemingly unrelated things will make the whole more complete?

Much like the Merkel shirt on a plumber, the above phrase is really asset allocation summed up in a nutshell. Add assets that should pay you cash flows, and do so in different environments. We did a few posts on this already, and I added a new one after reading the new edition of Gibson’s Asset Allocation book.

“Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.” -Talmud

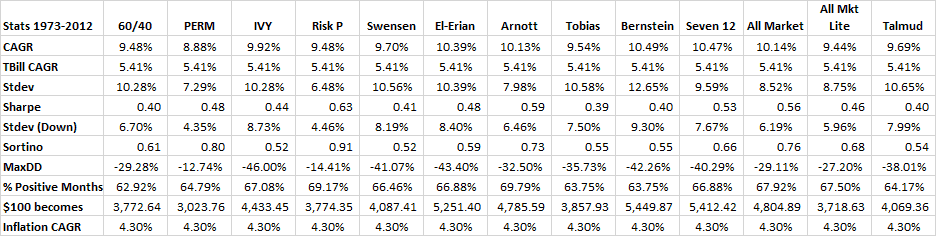

So I added a column for 33% REITs, 33% US stocks, and 33% in 10 Year US Bonds. How did it perform?

Basically the same as all the other asset allocation strategies. Buy and hold asset allocation is great, you just shouldn’t be paying people much for it…