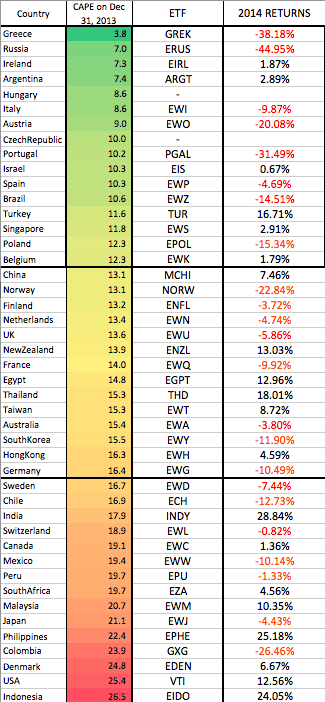

Readers know that I am a fan of using long term valuation metrics as a fundamental anchor to pick stock markets around the world. It worked great in 2013, but in 2014 that worked fairly poorly as many of the cheap markets have gotten even cheaper. I joked with a friend the other day that I was going to write a new edition of my book called Global More Value.

The median stock market had a negative year in 2013 of -1.33%

The average of cheap markets (defined as cheapest 25%) declined -12.88%

The average of expensive markets gained 1.36%.

The names have shifted around a little bit (I sent updated values to Idea Farm members earlier today) but the cheap ranks are still dominated by the continent across the Atlantic, and Russia and Brazil…