This excerpt is from the book Global Asset Allocation now available on Amazon as an eBook. If you promise to write a review, go here and I’ll send you a free copy.

—-

Rob Arnott is the founder and chairman of Research Affiliates, a research firm that has over $170 billion in assets managed using its strategies. He published over 100 articles in financial journals, as well as having served as the editor of the Financial Analysts Journal. His book The Fundamental Index: A Better Way to Invest focuses on smart beta strategies.

Smart beta is a phrase that refers to strategies that move away from the broad market cap portfolio. (So in U.S. stocks, think the S&P 500 versus a portfolio sorted on dividends or perhaps equally weighted.) The market cap portfolio is the market, and the returns of the market portfolio are the returns the population of investors receive before fees, transaction costs, etc. However, market cap weighting is problematic.

Market cap weighted indexes have only one variable – size – which is largely determined by price. (While not the topic of this book, market cap indexes often overweight expensive markets and bubbles – you can find more information in our book Global Value.) Many smart beta strategies weight their holdings by factors that have long shown outperformance, including value, momentum, quality, carry, and volatility. Here is a fun interview with William Bernstein on portfolio tilts. We are big proponents of smart beta and factor tilts applied to a portfolio.

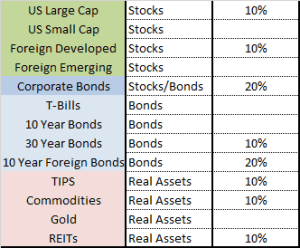

Below is one sample allocation from an article Mr. Arnott authored in 2008. Another solid performer! To be fair, there is a zero chance that he would have used market cap weighted allocations in his portfolio, but we’re trying to compare apples to apples for now. We examine one smart beta portfolio in the appendix.

FIGURE 33 – Arnott Portfolio

Source: Liquid Alternatives: More than Hedge Funds, 2008

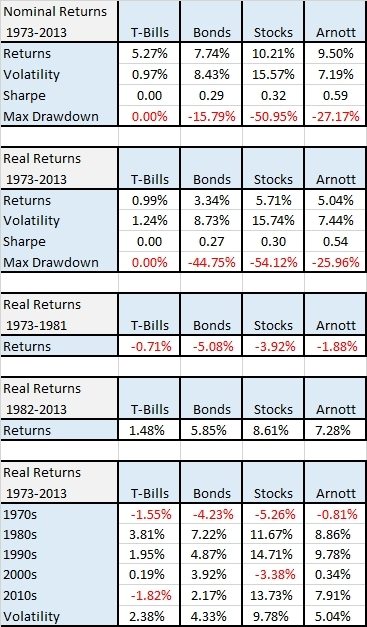

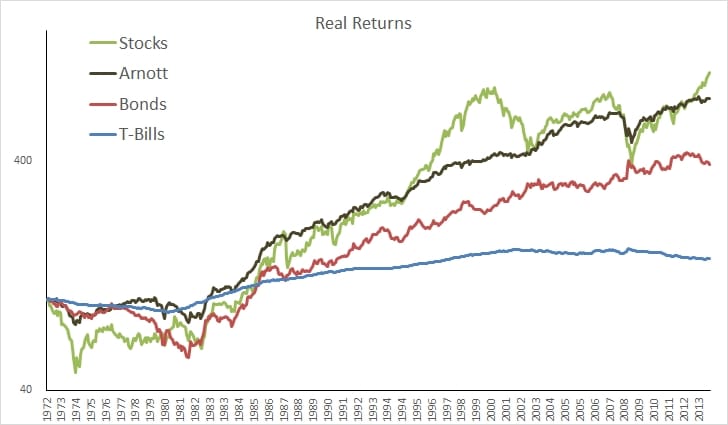

FIGURE 34 – Asset Class Returns, 1973-2013

Source: Global Financial Data