I like Five Thirty Eight. Their data driven approach certainly appeals like a quant to me. However, like many people out there, when they apply their logic to the stock market things start to go a little screwy. They posted a piece titled :”Worried About The Stock Market? Whatever You Do, Don’t Sell.”

I think that is fine advice for a buy and holder willing to sit through big, long drawdowns. We’re talking 50-90% losses here. If buy and hold is your system, then by all means, stick to your system! But realize the odds for buy and hold currently are very poor.

Even if your policy portfolio or approach is active instead of passive, nothing that would happen on any given day should change what you’re doing so 538’s advice “to do nothing” is correct. And I agree with them that emotional responses to markets is the worst way investors can react. Heck I run some buy and hold funds and realize that people trying to subjectively time the market is usually a disaster. However, the agreement ends there.

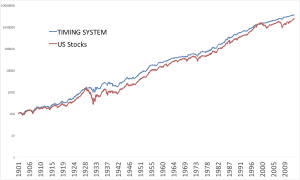

I firmly believe timing the market is not only possible, it isn’t that difficult. It is really quite simple and is based on common sense. However, for those looking for the holy grail this article isn’t it. Our market timing approaches work by reducing volatility and drawdowns. This is one reason many think that market timing isn’t possible – all they do is focus on returns when basic market timing works by not doing really dumb things, such as buying into bubbles.

Anyways, 538’s article looks at some bizarro system that “sells any time the market loses 5 percent in a week, and buys back in once it rebounds 3 percent from wherever it bottoms out.” I’ve been a CMT for about 15 years and have never heard of anything like this (closest maybe the ValueLine 4% system?) The author then decides to exclude dividends for some odd reason, and I’m assuming, also ignores investing the cash in T-bills or 10 year bonds. He then doesn’t use a log Y-axis, distorting the results.

Instead, lets boil common sense market timing into two basic rules. I posted a version of the below in April and September 2013, and even in our 2007 white paper so it’s nothing new. Here are the basic rules:

Don’t invest in expensive markets (defined as CAPE ratio above rolling average which is similar to below something around 16)

Don’t invest in downtrending markets (defined as price < 10 month SMA)

Otherwise invest in 10 year bonds.

Unfortunately, both of which happening now – an expensive stock market that is downtrending.

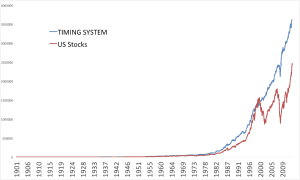

Click to enlarge.

An using a misleading Y-axis.

There are many ways to improve this so test your own variants and see what you think! But note they mainly work by reducing vol and drawdowns usually by 30-50%, but that’s a good thing!

Now, one could even go a step further, and instead of investing in the S&P500 sort individual companies by value and momentum as well. So you have the best of both worlds – great companies sorted by value and momentum, but also protected when stocks are expensive. To view these results go check out this awesome post on value and momentum from Alpha Architect. Even when they penalize results with a whopping 3% in annual fees and costs (way too high in my mind), the stock screen beats the market, and the hedges reduce volatility and drawdown. A nice combo for this sort of market!

Click to enlarge.