There are a lot of index funds in drag. Below are three must reads on the topic.

If you are going to stray from market cap weighting, it pays to be concentrated and very different. Otherwise, what’s the point?! Make sure you read all three, especially the blue bubble charts…

Seeking Alpha or Seeking Assets?

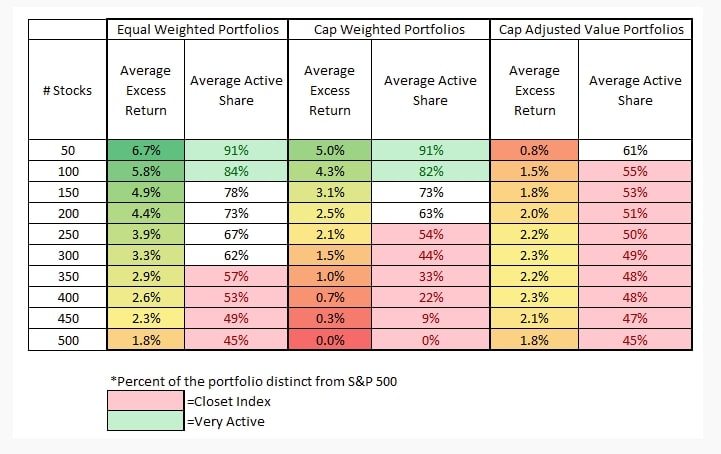

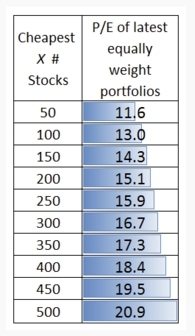

“What we learned

From this simple exercise, we learn the following:

- Concentration and equal weighting lead to portfolios which have better average excess returns and higher active shares.

- The equal weighted portfolios outperform cap-weighted and cap-adjusted value portfolios by an average of 1.8% and 2.0% per year, respectively—a wide margin in the U.S. large cap market.

- More concentrated portfolios have a much better valuation edge: stocks in the portfolio have much cheaper average value percentile scores.”

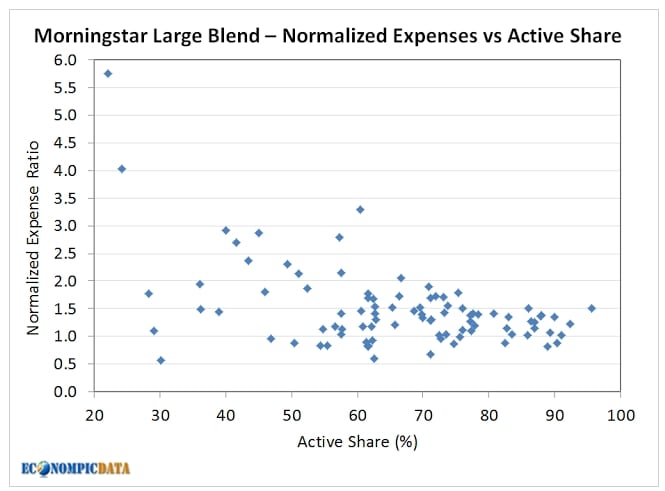

What You Pay Matters Less than What You’re Paying For

“Takeaway

When choosing an active manager, confidence in the team, the process, and the discipline the team has in following that process through various market cycles continues to be of obvious importance. As important is not the cost you pay in absolute terms, but rather what you pay for each unit of the skill they are selling.”

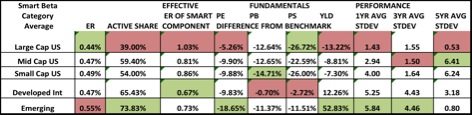

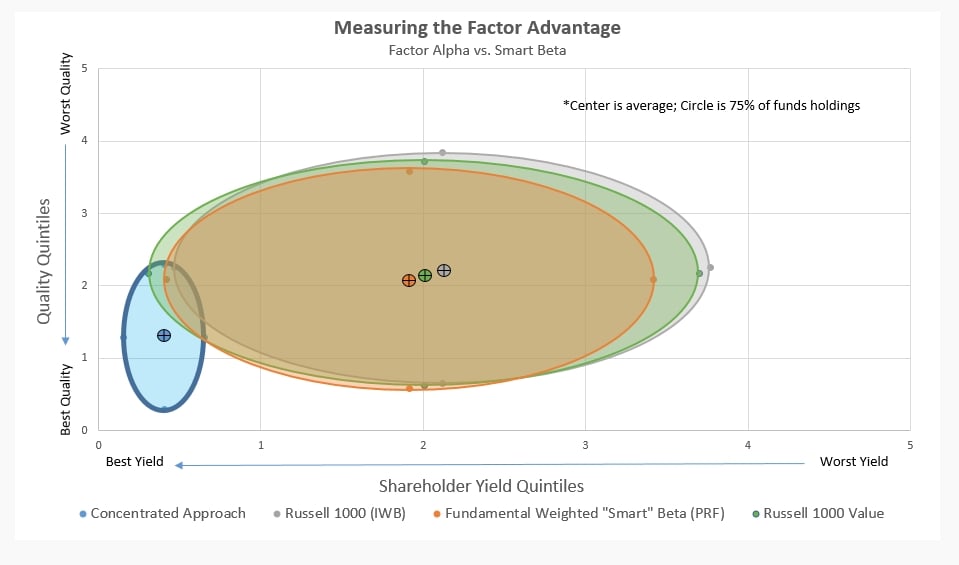

Measuring True Costs Of ‘Smart Beta’ ETFs