Back in early 2014 I penned a Market Outlook. The main points were:

1. 2013 – A Monster Year for Stocks

2. …But Valuation Will be a Headwind

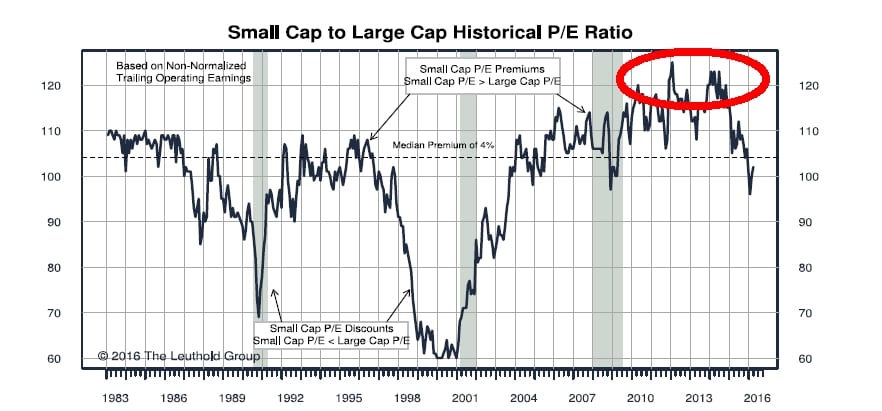

3. Small Cap Stocks and Dividends are Expensive

4. Bonds will not help a 60/40 get to 8%

5. Where to Look? Go Global

So, looking back, what would my comments be today?

1. True, they had a huge year in 2013, up 32%!

2. The valuations of US stocks (CAPE ratio) has actually gone up over this period, from 24.9 in 2014 to a current 26.2. Not surprisingly, stocks did about 9% CAGR over this period. With valuations still elevated, we would say the same thing – a headwind going forward.

3. We showed this chart, now updated, in 2014 to illustrate small cap overvaluation. Small caps have underperformed by a whopping 20 percentage points since 2014, and worked off all of their overvaluation.

Dividend funds, using the largest ETF VIG, are even more expensive now than in 2014 and we expect major disappointment there. The holdings according to Morningstar for VIG have a P/B of 4 and a P/E of 20! If you are going to focus on a cash distribution strategy, you know that I think a total shareholder yield approach with valuation metrics is a much better choice.

4. US bonds are yielding 1.6%, and many sovereigns are even worse (and some negative!), but as we illustrated in a recent white paper, high yielding global bonds are in a much better position going forward.

5. Foreign stocks have continued to underwhelm since 2014, with a cumulative 25 percentage point lag since 2014. The valuation difference vs. US stocks is at near all time lows for the cheapest bucket of global stocks, and we expect big outperformance going forward for the latter basket. Will check back in 2018!