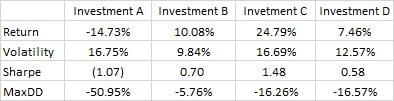

Let’s say you had the choice of the four following investing systems, which would you prefer?

Well of course you would say C,B,D,A in that order. Who wouldn’t? And well of course you know from reading me that this is likely a trick question.

Investment A and C are actually the same system, the S&P 500, and Investment B and D are likewise the same system. In this case B&D are a simple trend approach to the S&P 500 (long when above 10 month SMA, flat and in bonds when not).

They are simply measured over different timeframes. So, A and B are from Feb 2006 – Feb 2009, and C and D are from Feb 2009 – Feb 2012. I write this to illustrate a few things:

- A basic buy and hold beta allocation (S&P 500) can have massively different characteristics depending on the time frame measured. Sharpe ratios of -1.07 to 1.48! Think about that next time you get marketed an amazing track record with a 1.5 Sharpe..

- An active investing approach often goes years both outperforming and underperforming the benchmark. Monster outperformance in the first period followed by similar underperformance in the latter.

Pros often scoff at the inability of individual investors to stay the course with underperforming assets or strategies, but really the pros are just as bad as retail. Look at this recent survey from the FT and State Street. Let’s ignore the truly delusional return expectations of 400 institutional investors with $1.2tn AUM: 10.9%. No effing chance. (Also older post here.) But let’s examine this stat:

So, 100% of these managers would have fired the S&P 500 in the first period, and fired market timing in the second period….