We’ve written three fun articles on the topic of dividends in the past few years. I’m not sure why we haven’t seen more research here in the academic space, perhaps it is the hundreds of billions allocated to dividend strategies?

What You Don’t Want To Hear About Dividend Stocks

How Much Are Those Dividends Costing You?

The basic summary is that:

- Dividend yield investing is rooted in value investing.

- Historically, focusing on dividend yields rather than value, has been a suboptimal way to express value.

- If you have to focus on dividends, you MUST include a valuation screen or process to avoid high yielding but expensive, junky stocks.

- The hunt for yield has caused dividend stocks to reach valuations levels never seen before relative to the overall market.

- Since dividend stocks are currently expensive, we prefer a shareholder yield approach combined with a value composite screen.

- Once you have a preferred value methodology, AVOIDING dividend stocks in the strategy could results in additional post tax alpha of approximately 0.3% to 4.5% for taxable investors.

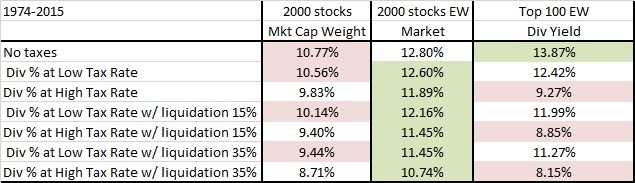

Here is a fun summary table that looks at dividend stocks with an after tax lens. Basically, the only time you would EVER want dividend stocks is in a tax-exempt account, and even then, you should prefer value.

Will probably put together a white paper on this topic shortly…

We looked at top 2000 stocks market weight, equal weight, and then the top 100 high yield dividend stocks equal weight. We then examined an investor that was taxed at either the lowest or highest dividend rates, and then those same investors that paid capital gains upon liquidation.

We color coded the top and bottom returning strategy for each tax bucket. Notice good ol’ equal weight beat almost everyone, and high dividends were only ideal in a tax exempt account!

Source: Wes & Jack and his crazy team of hackers

Next, we looked at using a simple value composite instead of dividend yield, and lo and behold, value beats everything on a pre and post tax basis. Even more interesting, a value approach that AVOIDS the high dividend stocks does even better after tax.

Click to enlarge

Source: Wes & Jack and his crazy team of hackers

Before you all send me 1000 emails about this study, just wait for the full white paper in a few months…but if you do have any suggestions to include in the paper, fire ’em over!