I just read El-Erian’s new book When Markets Collide this past weekend.

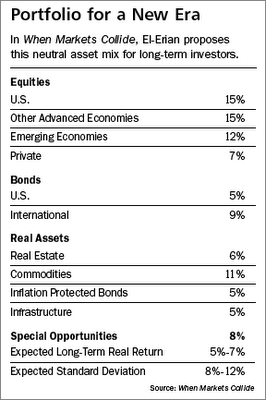

Am I the only person to notice that his allocation only adds up to 98%? Weird. (I just added 2% to cash.) I did like this quote from the book which reminded me of my post a couple months ago on optimizing happiness:

“There is growing talk about the importance of reducing noise lest it adversely impact quality-of-life indicators.”

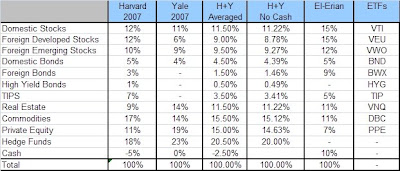

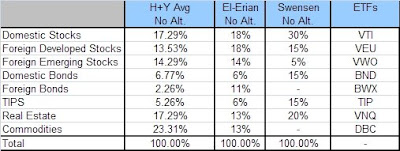

Anyway, below are the allocations of the Harvard and Yale Endowments vs. El-Erian’s recommended allocation. As you can see, it is a fairly similar allocation to the Harvard endowment, with a little more in foreign bonds and no allocation to hedge funds. I lumped infrastructure in with real estate so that it could be compared to the endowments on an apples-to-apples basis.

Following that is a comparison if you back out the private equity and hedge fund allocations. Special situations was lumped into cash. He described them as:

“investment opportunities that are attractive but do not fit comfortably into the categories I have covered so far…they usually relate to two types of activities: new longer-term activities that are supported by a secular hypothesis but are yet to gain broad-based acceptance; and shorter-term activities that materialize due to sharp dislocations that involve significant overshoots.”

This seems to be somewhat of a subjective recomendation and not all that useful for the retail investor. He mentioned water, agriculture, and carbon credits as three areas for the longer-term secular activities.

The expected return is right in line with the endowment allocation I mentioned in my paper, or roughly a 1:1 return to volatility ratio (about 10% return with 10% volatility and 20% drawdown over time).