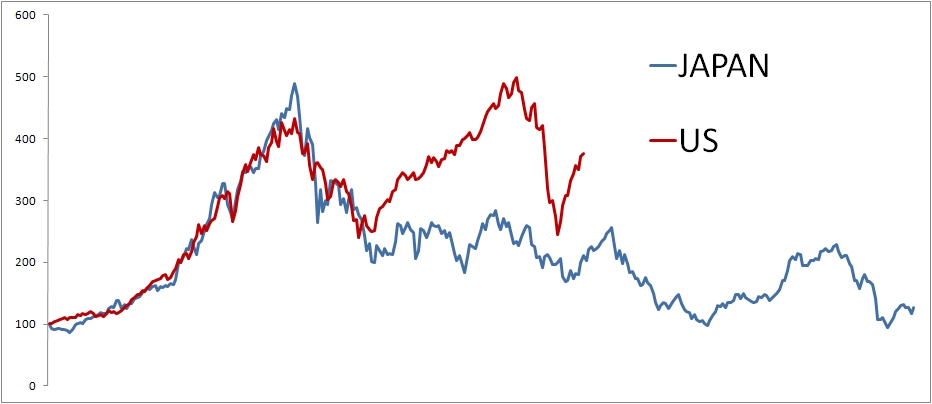

If you think what happened is happening in Japan can’t happen here, think again. We are already one decade in, the US has already experienced a lost decade. The question is, will there be more than one? If you compare both at their peak (Japan early 90s and US ’07) there are some similarities and some differences. Both had nice appreciation in real estate (Japan’s was higher), both had stock market gains, both had high debt (Japan more corporate, US more household). Savings was(is) higher in Japan, their current account and unemployment was better, the US has more population growth, and the US was more proactive in policy intervention.

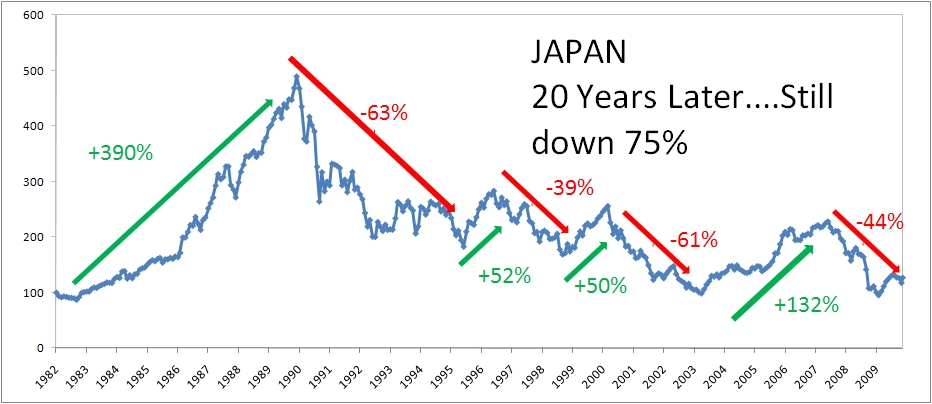

Regardless, both have had some nice rallies along with some nasty bear markets. Most importantly, is your portfolio prepared for the possibility (no matter how remote) of stocks being down 75% from their peak in another 10 years? Regardless of your opinion, you at least need to consider it. Charts below, Japan 7 years leading up to peak, then to present. US 7 years up to peak and to present. Both aligned with peaks.

And to answer the question in the comments about how the simple timing model would work over this period – it beats buy and hold by over 5% a year. More importantly it reduces volatility and drawdown by roughly half.

(Interestingly enough, Japan was one of my 5 Ideas for 2009. While it has done fine on an absolute basis, on a relative basis it has underperformed almost all other countries. I’ll take a look at the bullish case for Japan in January. Sentiment is TERRIBLE on Japan but valuations are low. More later.)