Below we have updated our 2006 white paper. While you can download the full 70+ page paper here, I’ve also chopped it up into a series of more digestible posts for the blog.

EXTENSIONS

Other than simplicity, there is no reason to only focus on five asset classes. (Technically, we believe there are only four real asset classes: stocks, bonds, commodities, and currencies. Everything else (like REITs) is a combination of the prior four.)

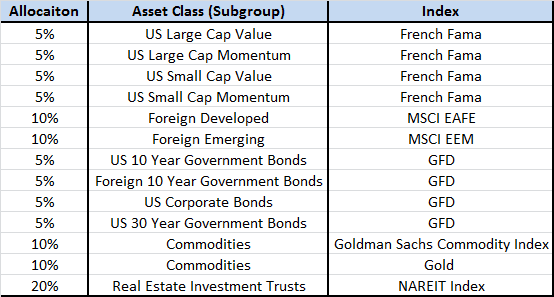

At the same time, expanding a portfolio with allocations less than 5% of the total does not do enough to move the needle on the entire portfolio’s risk and reward characteristics. (This ignores derivatives and holdings with highly asymmetric payoffs).

We also have the challenge that many asset classes and indexes simply have not existed for a very long time. For example, we do not include TIPs, junk or high yield bonds, emerging bonds, foreign REITs, fundamental indexes, managed futures, currencies, or other asset classes we might otherwise consider. However, thirteen asset class subgroups will likely cover the majority of the world that we would like to allocate to.

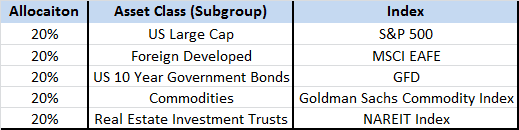

Below we expand the original portfolio from:

…to include the following:

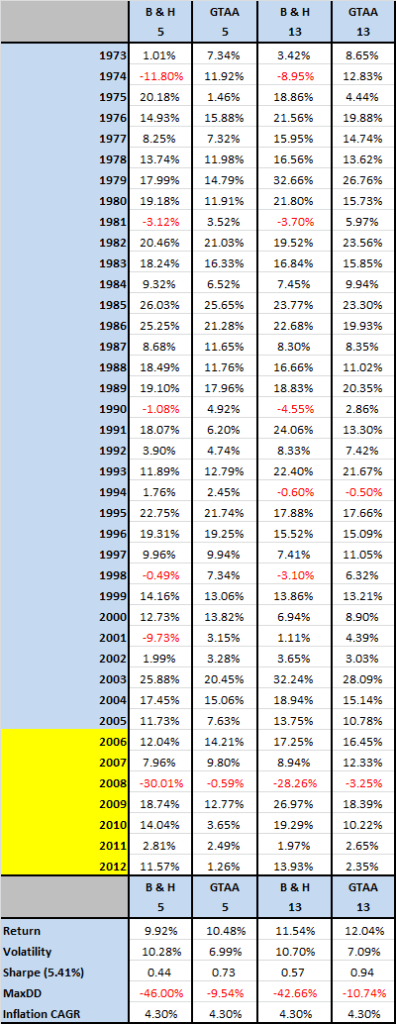

We then take a look at the historical returns compared to the simple strategy of five asset classes. As you can see, it improves returns about 150 basis points, likely enough to warrant increasing the assets in the portfolio.

Figure 18: Buy and Hold and GTAA Portfolios, 1973-2012