I’ve done a ton of posts on home country bias (people allocating more to stocks in their own country). Most US investors place 80% in the US, when the US is only ~50% of global market cap and about 20% of global GDP. Interesting to note, that of their public equity exposure, Harvard and Yale only allocate 1/3 to the US.

Valuations abroad are much more reasonable than in the US (CAPEs in EAFE and EEM around 15/16 vs 25 in the US, and small caps are at 30).

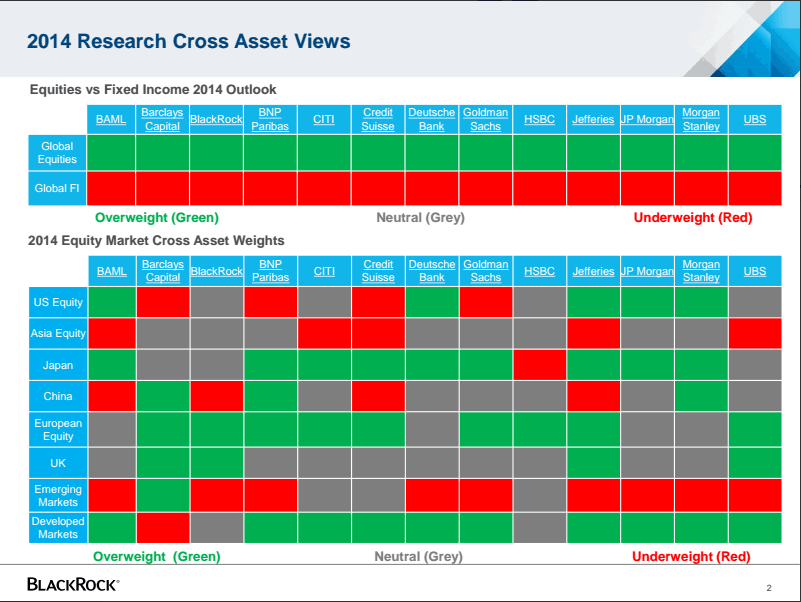

More interesting to me, all the strategists hate emerging! via @ritholtz