because of “X”. Market participants love focusing on the details while often avoiding the greater picture. And almost always they find ways to justify whatever market stance they have. Most bulls are now finding holes in all the valuation metrics the same way most bears in 2008 and 2009 were finding ways valuation metrics were different that time. They never are.

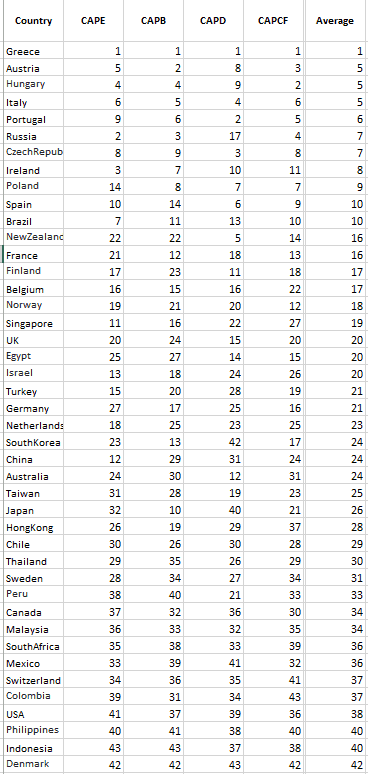

So, my argument to the CAPE ratio haters – fine, don’t use it. Let’s substitute in dividends, book values and cash flows, three totally different metrics. I sent this piece to The Idea Farm the other week with actual values, but below are the rankings for all the countries in the world by the four metrics, and then by an average of all . Notice anything?

They all agree. (For the most part, not exact of course… ) Poor Denmark.