Bridgewater is the world’s largest hedge fund at $160 billion, and employs over 1,400 people. You can find a 140 page document on the culture of Bridgewater if you would like to know more about how the company works. And if you want to know more about how the economy works, here is a fun video.

They manage two main portfolios. All Weather is their buy and hold “beta” offering using their risky parity methodology. Often Dalio mentions that is how he would invest for his trust or if he passed away and needed a simple allocation for his children etc. You can find more info on All Weather in these publications on Bridgewater’s website:

Engineering Targeted Returns and Risk

(Pure Alpha is their active multi-strategy product.)

From the “Risk Parity is About Balance” article:

“Since 1996, our All Weather approach has been stress-tested through significant bull and bear markets in equities, two recessions, a real estate bubble, two periods of Fed tightening and Fed easing, a global financial crisis and periods of calm in between. Through these varied environments the All Weather asset allocation mix has achieved a Sharpe Ratio in line with the 0.6 expectation that we established at the outset of the strategy, and also in line with its performance over 85 years of back-testing.”

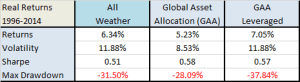

Below is a chart of the real-time returns to All Weather since inception in 1996 compared to the simple global market portfolio. (We will call GAA for short – note this isn’t our new ETF although they are very similar.) The allocation is roughly 50% stocks, 40% bonds, and 10% real assets. More specifically it is 20% S&P500, 15% EAFE, 5% EEM, 22% Corporate Bonds, 16% 10 Year Foreign Sov Bonds, 15% 30 Year US, 2% TIPS, 5% REITs.

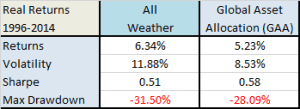

How do they compare? Below are the real returns net of inflation.

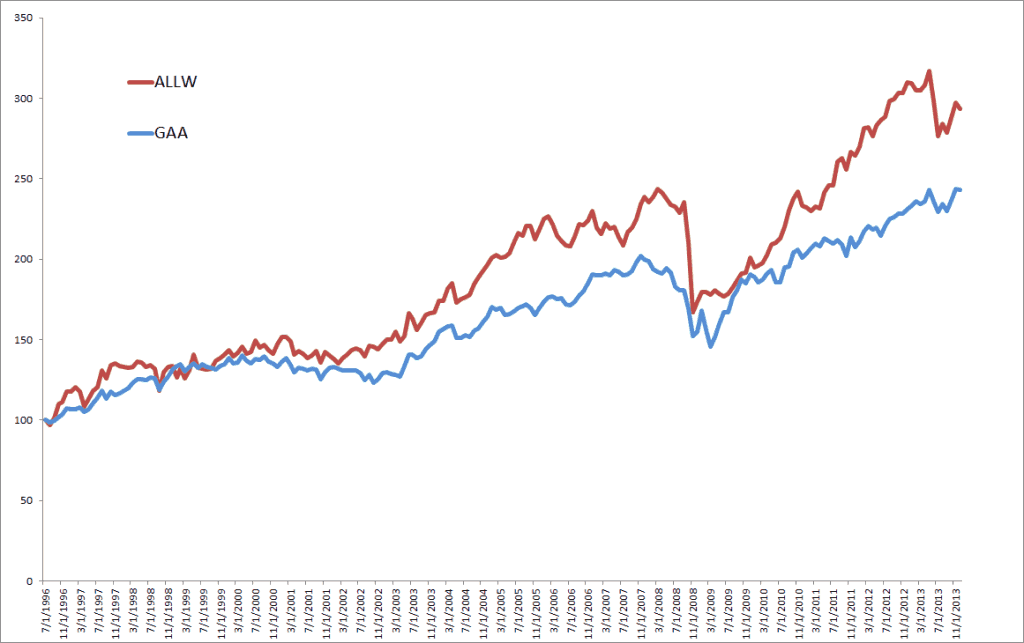

To compare apples to apples, let’s leverage up the GAA portfolio to similar volatility as All Weather as it uses leverage as well. This is more challenging for individuals since most brokerages charge criminal margin rates, but futures allow institutions to use low cost leverage. The global market portfolio is leveraged about 40%. As you can see the results are very similar, in fact GAA outperforms All Weather, likely due to fees and transaction costs GAA doesn’t include in the backtest due to using index only data. Then again GAA isn’t trying to optimize the portfolio or returns, but is just a very, very basic global portfolio. Note – that isn’t a slight against Bridgewater but rather a compliment, if you are going to do buy and hold the global market portfolio is a great allocation that holds up in most market environments.

Pretty cool you can get access to the world’s largest hedge fund strategy for free by just buying the global market portfolio…

This just goes to show, if you’re going to do buy and hold, pay as little as possible!