We examined 15 famous asset allocation strategies in my last book Global Asset Allocation. (If you haven’t read it yet I’ll send you a free copy.)

I would like to have included a lot more tactical ideas in the book but there is a constant struggle between keeping an idea/book simple, but satisfying the supernerds like me with enough of a deep dive into the data. Ironically I spent a ton of time on editing the books down to only include the basic info, and the biggest complaint for those books – they’re too short! People somehow equate length with value, but I can’t think of anything worse than long books that should be much shorter. There was a tweet the other day that said, ” Most books should just have been mag articles, most articles should be blog posts, most blog posts should be tweets & most tweets never sent.” So, I didn’t go down the rabbit hole of tactical ideas but just directed people to prior works.

But I’ve also said a handful of times that an allocation of 1/3 global stocks, 1/3 global bonds, and 1/3 trend strategies is a pretty hard allocation to beat. A lot of people have asked me to expand on that comment so I’m going to do so in this piece.

I also publish my personal portfolio each year that is roughly 50% trend or tactical strategies and 50% buy and hold strategies (with tilts) so people can understand I eat my own cooking. Not that my personal allocation should matter to anyone, but it let’s you know how I think about the world and implement it with my own hard earned money. Next time you sit down with your advisor, ask them specifically what they do with their own cash. It may surprise you!

I’m now going to go down that rabbit hole to explain those ideas I left out of the book in a bit more detail.

Subscribers of The Idea Farm get access to an Excel download that lets you backtest buy and hold and simple trendfollowing strategies back to 1972. We used a similar Excel model to run all the tests in the GAA book. I plan on updating it again in 2016 with new data.

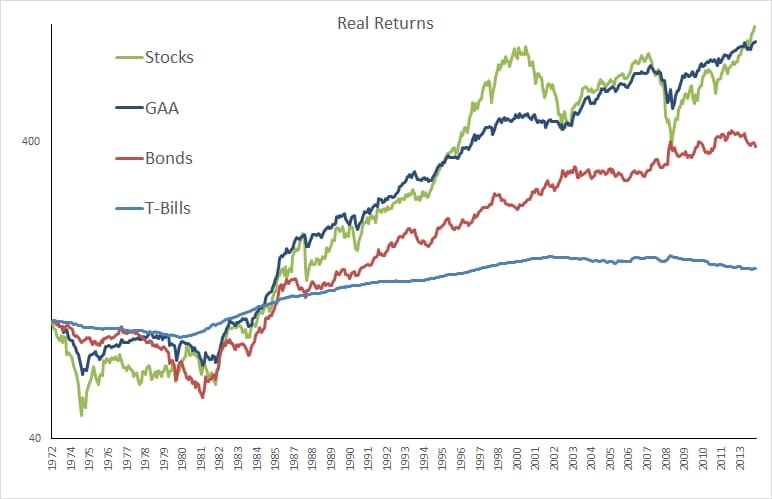

So, first let’s refresh the ideas in the book with some of the standard benchmarks. The “GAA” portfolio is from the book, and is simply the global market cap portfolio with commodities added.

US Large Cap 18%

Foreign Developed 13.5%

Foreign Emerging 4.5%

Corporate Bonds 19.8%

30 Year Bonds 13.5%

10 Year Foreign Bonds 14.4%

TIPs 1.8%

REITs 4.5%

Commodities 5%

Gold 5%

I’ve yet to figure out why WordPress displays my charts blurry until you click on them – if you know please email me. In the meantime, click to enlarge the charts with more resolution.

So, now what about the 1/3 each model?

I took to Twitter for some ideas on what to call this portfolio. A few of the funnier names are below.

-

Momentum Trinity

-

WisdomFree

-

The Global Triumvirate

-

Jessica Biel Sextape

-

3 amigos

-

Managed-a-trois

-

Trending with Meb

-

Cold cut combo

-

Tripod

-

The Three Stooges

I sort of like the Trinity Portfolio so let’s go with that for now (via @daniel_egan). So, we’re going to use as the CORE the GAA portfolio from the book with the allocation above, which is pretty close to 50/50 stocks and bonds with some commodities thrown in. Then, we’re going to add trend for a third of the allocation, or GAA 66% and trend 33%.

But what trend index to use? There isn’t a great one that has existed back to 1973, so of course you’re going to have to rely on simulated data. (But to be fair most of our indexes in the normal allocation didn’t exist as indexes at the time either such as TIPs, commodities, emerging markets, etc).

So, we’re going to use two variants.

1 – BTOP50. This only goes back to 1987 so we are going to supplement it with the AQR simulation prior to that. Note also BTOP is after fee index, all of the rest are gross.

2. Global Momentum (GMOM). This is similar to the aggressive version from our old paper, basically invests in the top 1/3 of assets ranked on momentum, but only if above their long term trend, otherwise in cash. (You could also add the moderate or conservative allocations with vol reducing properties rather than return enhancing.)

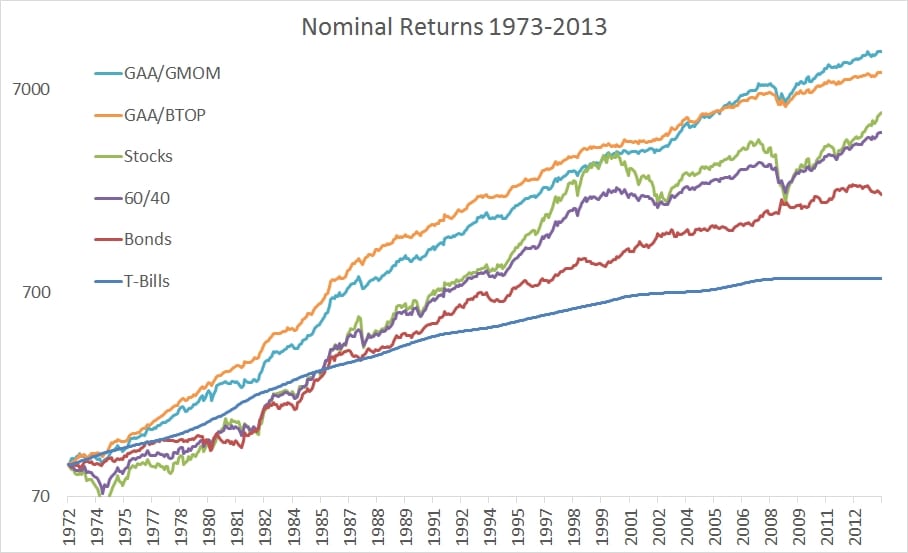

Nominal returns. Click all charts to enlarge.

Nominal returns to 1973

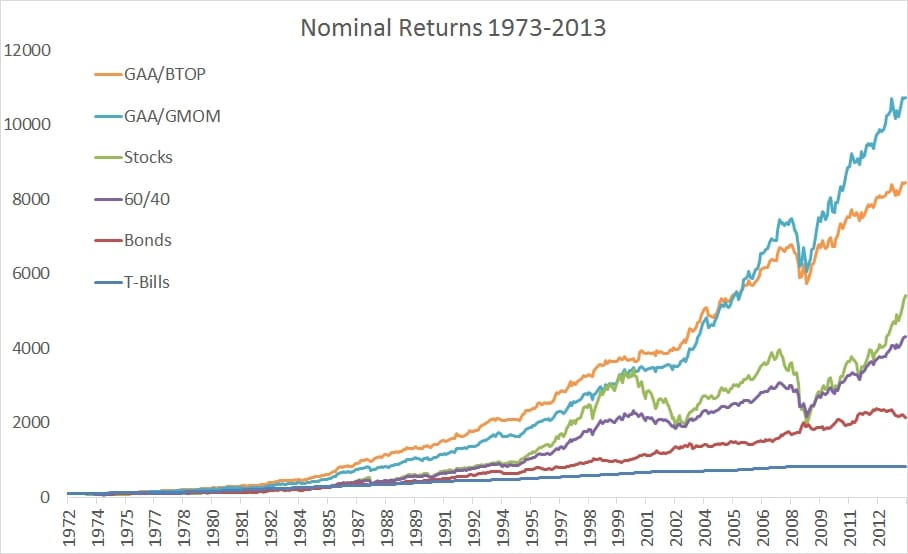

And the incorrect Y axis that the marketing crowd would love…

So you can see that the trend component helps keep volatility low, but more importantly reduces drawdowns. Managed futures and trend systems are one of the few really decent strategies, along with US gov bonds, at diversifying a traditional stock heavy portfolio. Implementation is still a little tough as most trend/managed futures strategies can be very expensive (particularly the fund of funds ones) but there are some current mutual funds and likely some ETFs coming to market that are reasonable. If you recall the main conclusion from my book, fees can destroy any well built portfolio.

Why is this a great allocation (although my personal is more “extreme” at 50% trend)? It checks the boxes for most clients, institutions, and pros.

1. It has the global portfolio as the core. You get the benefit of all of the asset classes in the world that have delivered positive returns over the years. You’re also never “too different”. Stocks, bonds, REITs, commodities, gold – it’s all there.

2. It is a truly global allocation. No home country bias here, lots of exposure to foreign assets as well as domestic ones.

3. It does well in various market environments. Historically, the addition of trend systems improves risk and return numbers.

4. You are doing something during bear markets. Lots of advisors are challenged with what to do during bear markets. Telling clients to sit still, or just wait out the losses is tough. Allocating to trend strategies allows you to have a portion of the portfolio that is “doing something”. Even if you think that trend will not add any return or risk benefits, there can still be behavioral or psychological benefits to adding the system.

5. You’re not “all-in” anything. Investors often like to pick out a niche (a dividend investor, a bond guy, a value person, a gold bug, etc). This allocation lets you spread your bets across over 30,000 global securities, all the while never having all of your eggs in one style or strategy basket.

6. You can add tilts. I didn’t mention this here, but you can improve this portfolio by moving away from market cap weights in stocks and bonds and add another 1-200 bps to the returns. Simple value and momentum indexes can add a lot of value within asset classes.

Most advisors and institutions will never add trend to their portfolio, and if they do, they may add 10%. The funny thing is if you did a bling mean variance optimizer, one of the largest allocations is almost always managed futures and trend.

Let me know any thoughts or questions and I will update the post with more content!