I’ve talked to death about roboadvisors, asset allocation, and ETFs over the past year. In general it is a wonderful time to be an investor, and many robos have reduced the cost of managing an asset allocation portfolio down to about 0.25% (plus ETF fees) with tax harvesting included. I think they are wonderful and have recommended them to many individuals. Many advisors have been wringing their hands over the fee compression – how can we compete in a world where asset allocation is a commodity?

The answer is – because asset allocation has always been a commodity.

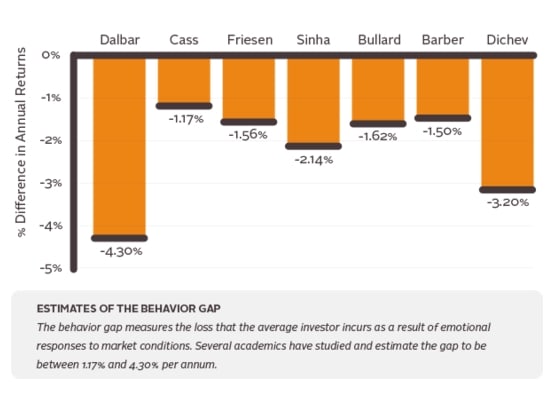

Look, the vast majority of financial advisors don’t offer any investment alpha. Hell, the vast majority of investment managements don’t either! So the advent of the robo technology should be seen as a boon to advisors – it simply frees up your time to focus on what matters most to your practice. And that is where your value is, and has always been. Josh Brown often says that behavioral coaching is probably the top value add, and I agree. Look at this table I posted on Twitter the other day from AdvicePeriod on the behavior gap in investing:

Since almost every custodian and brokerage will have no cost robo technology for their advsiors in the next year or two, advisors should spend as little time as possible on the asset allocation solution, and more and more on their value ads. But that is a beautiful thing! Clients would appreciate more attention, estate planning, insurance, tax management, microbrew tasting events etc etc. Not to mention it would free up advisors to spend more time on prospecting if they so choose.

So don’t fret advisors, see the robo/ETF revolution as a major benefit to your practice…but looking out, what is the next evolution in the robo tech world? Actually, I think the next step is the evolution of the ETF as an investable asset allocation benchmark at a 0% fee. Let me explain as many don’t quite get this.

Roboadvisors usually charge about 0.25% (though Schwab is 0-.10% with some weird issues), but are still at a fee disadvantage to a no management fee ETF (of which only one exists, but more coming). If I had to pick just one platform to invest in for total performance, tax efficiency, and simplicity – an ETF wins out. (But again, they’re both good choices.)

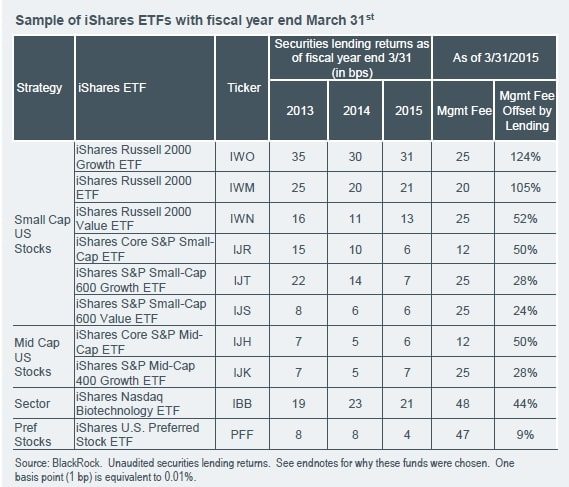

But the really cool area that no one talks about, mainly because it is a little arcane, is that through share lending an ETF could eventually get to expense ratio negative. Think about that for a second. You could eventually hold a fund that pays you to own it…See below graphic (and PDF download here) for more info…there are many ETFs where the management fee is actually negative. If you could then lend those underlying ETFs as well…