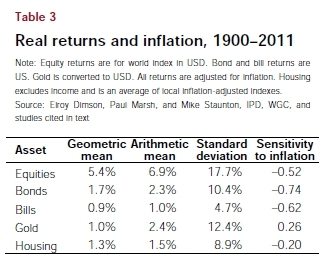

I often reference the 5:2:1 rule on the podcast. Those are the real returns, net of inflation, that stocks, bonds, and bills have returned the past 100+ years. You could add in gold and housing to the 1% section too as they all do about 1% per year. (People are often surprised, and hate to hear that about housing for some reason.)

From the 2012 Global Investment Returns Yearbook. Which, by the way, reading all of the archives here is like getting a Masters in Investing. Highly recommended to read them ALL (including Triumph of the Optimists.)