About nine years ago our good friend Matt Hougan wrote an article called “The World’s Cheapest ETF Portfolio”. He outlined a portfolio with the following allocation:

40% Broad Market U.S. equities

35% Foreign Equities

15% Fixed-Income (broadly diversified)

5% REITs

5% Commodities

It weighed in at a super cheap 16 basis points! The following years have seen fees continue to decline. This fund allocation above would now cost an investor a bargain basement 9 basis points! (Only problem with these is they are market cap weighted, which we’ve talked about as being suboptimal.)

That is a pretty awesome decline. But as Cliff Asness stated a month ago on Twitter:

“Moving from a 150 bps fee to 25 bps, huge. Moving from 25 bps to 10 bps, ok but not huge. The move from 5.0 to 4.5, deeply irrelevant.”

We live in a world of incredible investment choices, where there are lots of great choices to implement global portfolios.

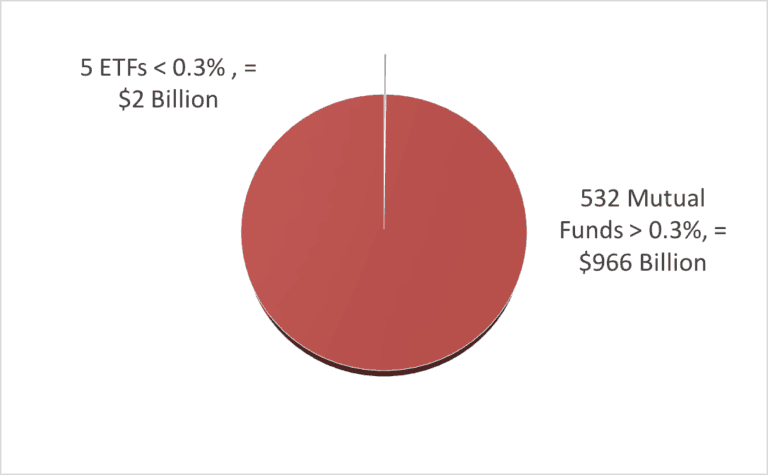

For example, there are 5 global asset allocation ETFs that charge 0.25% or less (my company Cambria manages one). That’s awesome! The below chart demonstrates this concept. Pretty cool right? They manage about $2 billion in assets.

You can also invest in a automated investment solution like a digital roboadvisor, many of which can get you a portfolio with no trading commissions and a total expense ratio of about 0.5%. Still awesome!

What’s not awesome? Most investors aren’t particularly fee conscious. Here is an excerpt from an old post:

There are over 500 asset allocation mutual funds that charge over 0.3% per year, with an average fee of 1.13%, and many above 2% per year. How much do they manage? Almost a TRILLION dollars. Let me repeat, almost a TRILLION dollars.

The slice of the pie for the low fee ETFs is so small that you cannot even see it on the chart. How much extra is Wall Street siphoning off from your wallet vs. the low fee ETF option? $8 billion dollars a year. That is an extra 0.83% per year you are giving to mutual fund managers.

Oh, and by the way, 71% of these mutual fund managers have $0 invested in their own fund. Maybe there is a reason for that?

This is why we often say the low fee ETF revolution is still in the early stages. Lots, and lots of fat to trim from the traditional high fee mutual fund space.