That headline was a response I received from a handful of friends regarding my last post on buying puts as tail risk insurance.

And I agree. Well, sort of.

It’s been long known that there exists a premium for selling insurance…hey, otherwise why would anyone do it?

Now what if you could combine the best of both? Selling vol to capture the premium but buying vol to protect against big down moves?

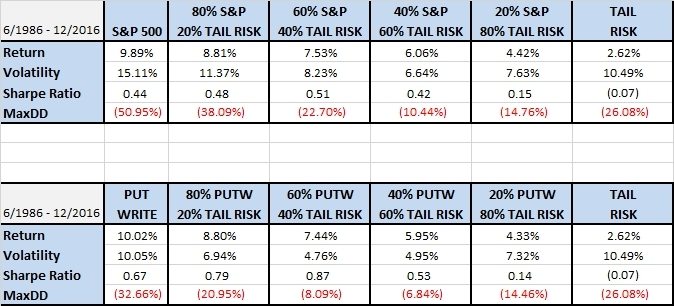

Below we re-ran the simulation with the following:

- S&P 500 total return

- Tail Risk strategy – The tail risk strategy we will utilize is the same one from the last post that buys monthly 5% out of the money options on the S&P 500. We then invest 90% of the portfolio in 10-year U.S. government bonds.

- Put Write strategy – The PUT strategy is designed to sell a sequence of one-month, at-the-money (ATM), S&P 500 Index puts and invest cash at one- and three-month Treasury Bill rates. The number of puts sold varies from month to month, but is limited so that the amount held in Treasury Bills can finance the maximum possible loss from final settlement of the SPX puts.

We replaced our prior S&P 500 allocation with the Put Write strategy, and lo and behold it really helped returns. Your portfolio is essentially:

Selling monthly S&P 500 ATM puts with the rest in cash, buying 5% OTM puts with the rest in 10 year bonds…impressive!

6/1986 – 12/2015

CLICK TO ENLARGE

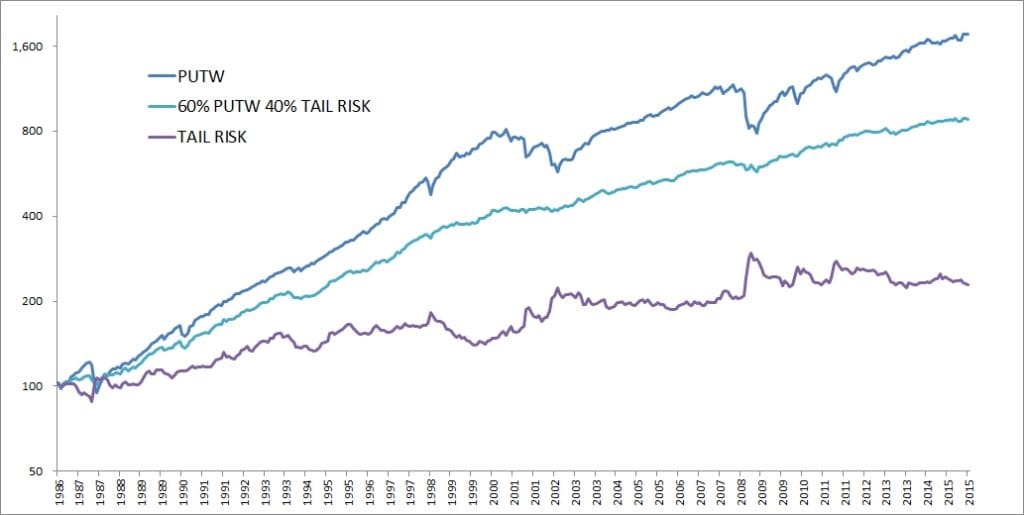

And the equity curve,