Many investors dream of passive income. They picture themselves on the beach sipping a pina colada, and enjoying the income of their portfolio rolling in. (But let’s be honest, the Hans Gruber yield days are long gone…) What would you do to achieve an extra 1% or 2% a year, and consequently, an extra $10,000 or $20,000 on your portfolio?

I know what the investment management industry would spend. Billions of dollars and a gazillion man hours of time trying to add just a smidgen of yield. Swensen’s old book Pioneering Portfolio Management depicts the spread of top quartile vs. median returns for active managers across a handful of asset classes and strategies. If you’re a stock manager you are top quartile if you just add 0.9% percentage points. In bonds it’s 0.3 percentage points. (Granted this arguement also applies to the reality that it makes more sense to be active where active helps, ie private equity, small/foreign, absolute return, and real estate.)

So, if I could tell you there is a way to add a little yield, but five or even ten percentage points to your annual returns? You’d be interested right?

Well, here’s my advice.

Do nothing. Actually, don’t just do nothing, stop doing what you were doing before. Let me explain.

I think it is a great endeavor for investors to spend time learning about investing, and the history of markets. Bill Bernstein and I talked about this at length on the recent podcast. Having realistic expectations, and well and knowing how markets have performed in the past will keep you from doing really stupid things in the future. Well, hopefully at least.

Lots of people study markets in the hopes of beating the market. What a lot of people don’t factor into their equation is the time spent to achieve that goal.

So, instead of figuring out how much extra juice we can squeeze out of that portfolio, let’s flip the equation around.

How much alpha do you HAVE to generate to break even on the time spent to achieve it?

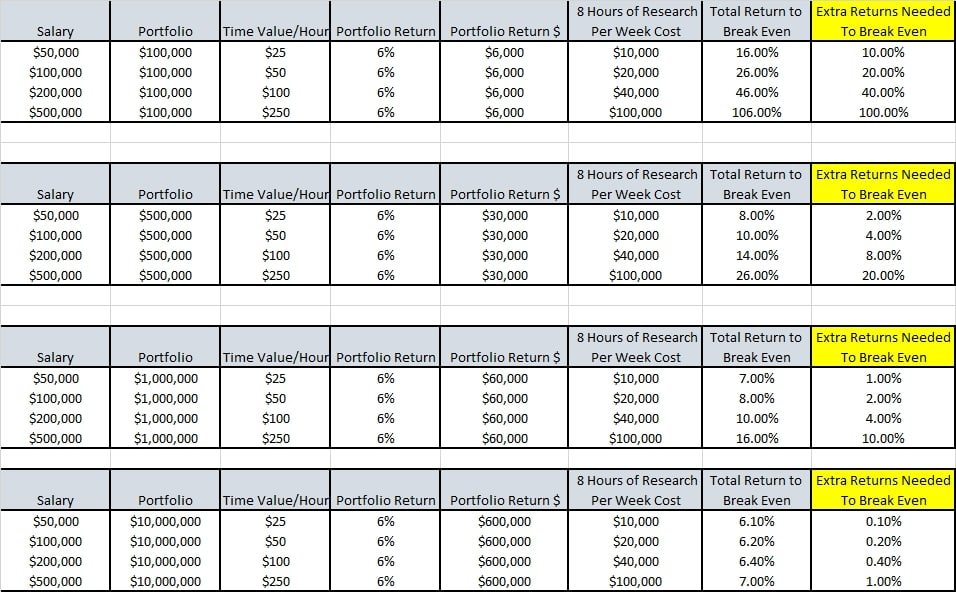

Below, we take a look at a handful of scenarios for investors making between $50,000 to $500,000 per year, with portfolios ranging from $100k, to $10,000,000. We examine an investor who spends eight hours a week studying markets in hopes of beating a basic portfolio allocation. We chose eight hours at that was the responses to a poll of mine with over 500 votes on Twitter.

In nearly every case, it is a more realistic scenario to spend zero hours on investing, and simply work a few more hours and achieve a much higher yield on your entire portfolio.

Only once you achieve family office levels of wealth does it make sense to be spending ANY time on your portfolio…The best way to add yield to a portfolio is to ignore it!

This is one reason we are such strong advocates of the new digital advisors…not only do they automate the entire process, but they are low-cost, tax-efficient, and in many cases, commission free. And from someone who has automated his own process, as well as running it for over 400 clients, I cannot fathom ever going back.

So, the simple advice is this: Implement a low-cost, tax-efficient, rules based portfolio. Pay low or no commissions. Automate it if you can. Invest in yourself. And then move on and order up that pina colada…

BTW, the final column is extra returns in PERCENTAGE POINTS needed to break even….

The Cost Of Your Personal AlphaQuest

Click to enlarge