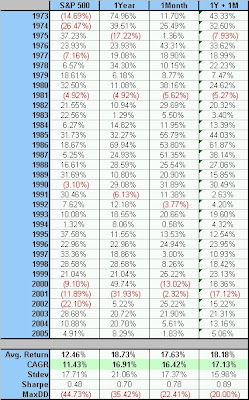

Readers have been emailing me about the returns of the models I have presented in the last few posts. Rather than respond to all of them individually, I thought I would just post the year by year returns for the S&P500, the 1-Year MO model, the 1-Month MO model, and a combo of the two models. Recall that no estimates have been subtracted for commissions, fees, or taxes.

Readers have been emailing me about the returns of the models I have presented in the last few posts. Rather than respond to all of them individually, I thought I would just post the year by year returns for the S&P500, the 1-Year MO model, the 1-Month MO model, and a combo of the two models. Recall that no estimates have been subtracted for commissions, fees, or taxes.

(You may have to click on the Table to get it to open in a separate window for better viewing)…

You will notice the effect the higher volatility has on reducing average return to a lower CAGR than a lower volatility with the same return. Ed Easterling [2006] has a good discussion of these “volatility gremlins” in John Mauldin’s Book, “Just One Thing”.

(Note: The combo model is a simple average of the other two models, rebalanced yearly. The drawdown figure is an estimate.)