Joel Greenblatt recently wrote an investment book titled “The Little Book That Beats The Market.” It included a description of an investment strategy focusing on a magic formula with two inputs – high return on capital and a high earnings yield. The book is a great intro into factor based equity screening. Currently he owns four stocks – Wal Mart (WMT), American Express (AXP), Autozone (AZO), and Aeropostale (ARO). You can follow along with his holdings here.

Interestingly enough, Grennblatt’s siter runs her own hedge fund (Saddle Rock Capital) with ~ $170M AUM. Even more interesting, she only owns two stocks – Aeropostale(ARO, 2.9M shares) and Abercrombie and Fitch (ANF, 1.2M shares). Talk about some serious cajones! But then again, it was none other than Buffett himself that said, “Wide diversification is only required when investors do not understand what they are doing.”

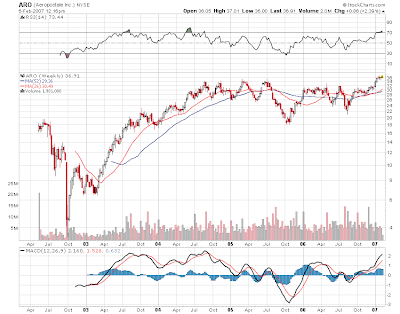

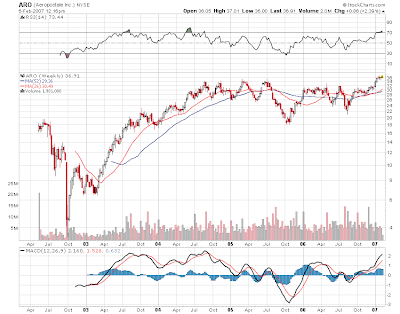

So, the Greenblatt’s own over 3.5M shares of ARO, and its at new highs after breaking through a quadruple (quintuple?) top. Technicians everywhere are salivating. . .

But does high conviction as an idea result in excess returns, or is it simply an example of the gambling nature of hedge funds?

Morgan Stanley has developed a screen based on the hedge fund conviction premise. They examine stocks in the S&P 500 that have 1) high hedge fund ownership in percentage terms, 2) but owned only by a few funds (meaning it is their best idea(s)).

They take the top 25 stocks where the hedge funds own the highest % of shares outstanding. From that list, they select the 10 lowest number of hedge fund positions. They rebalance 15 days after the 13Fs are filed (60 days after the Q end). Their database includes survivor bias (it doesn’t include stocks that are no longer traded), which, at least in our research so far, biases the results up a few hundred basis points.

Regardless, they found the strategy significantly outperformed the indices over the 1999-2006 time period. The results are a bit fantastic (500% total return for the strategy vs. ~ 20% for the S&P over the same time period), but it bears watching.