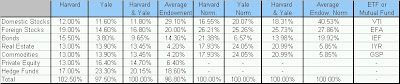

Below is a table constructed from the 2006 Annual Reports from the Harvard and Yale Endowments. Similar in content to my previous post analyzing how a simple buy and hold can replicate the returns of the top endowments, this post focuses on comparing the endowments to the timing strategy mentioned in my paper.

I added a column for the “Average Endowment”. The final numbers are similar to the last update, with the exception being an additional 5% allocation to foreign equities at the expense of bonds. It is interesting to note the very low allocation to bonds by the Yale endowment ( < 4%). I also divided the Real Estate and Commodities evenly, as the report did not break out the %ages for the "Real Assets" category.

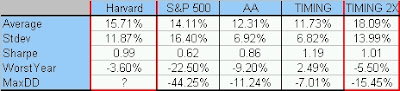

Below is the Table comparing the returns from 1983 – year end 2004 for Harvard, buy and hold of the five asset classes evenly weighted (AA), and the Timing strategy on the same asset classes. 40 bps were deducted from the buy and hold and timing ports for ETF/mutual fund fees, which were rebalanced yearly. The Sharpe Ratio is slighly superior to Harvard’s returns.