Backtested results may not reveal the effects of unanticipated shocks to the system.

Most managed futures trendfollowing systems have seen historical declines that exceed their CAGR, with many approaching 50% or more. Flipping through the new book on the Turtles, I came across a great chapter on price shocks. In the passage Curtis Faith describes how his $20M trading account lost $11M in the day AFTER the Black Monday crash of 1987. The drawdown occurred overnight, and there was no chance to exit the market.

He then goes on to illustrate a historical backtest that reveals this particular drawdown was two times greater than anything seen in historical testing. He states, “All traders who wish to stay in business would be prudent to keep the reality of price shocks in mind as they settle on an appropriate risk level for their accounts.”

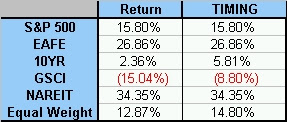

I thought I would update the hypothetical results had you followed my timing system for 2006 below (no fees deducted from either series). This year is the first out of sample (although the publication didn’t hit stands until 2007):