A good article in Forbes magazine this month:

I have discussed various cross-market momentum strategies on the blog in the past, and you can view two below:

Simple Cross Market Momentum

Cross-Market Momentum Follow Up (with link to the COP Strategy)

The Forbes article features a strategy by Robert Colby. He ranks 200 ETFs on 6-month momentum, and forms portfolios of the top 10. The article mentions that he rebalances frequently, but does not say how often. This simple strategy is backed by solid academic evidence, although I admit using 200 ETFs is probably overkill due to high correlation and overlap. 50 or so should be sufficient. One of the problems with using so many asset classes is that the portfolio could be heavily concentrated in one general asset class. Reviewing the table in the article, all ten holdings are foreign markets.

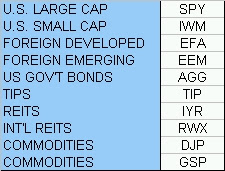

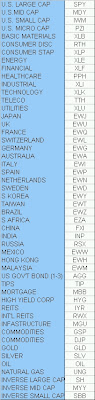

I would be curious if Colby uses any of the leveraged or inverse funds. Below is a sample list of 10 and then 50 ETFs one could use in a ranking system: