It’s the Covariance Stupid!

There is a great discussion of some asset allocation topics in Bernstein’s new book, “Capital Ideas Evolving”. (However, the first half of the book I skimmed). In the chapter profiling the Yale Endowment:

Swensen describes the process this way: “Mean/variance was a powerful influence in causing us to move away from the standard institutional portfolio. You never get a recommendation of 65% equities from mean/variance – it’s always telling you to move toward diversifying asset classes that promise equity like returns. These kinds of results led us to emphasize private equity and venture capital, real estate, hedge funds offering long/short or absolute return strategies, and investments in raw materials like timber.”

…Along the way, Swensen has been faithful to one of Harry Markowitz’s favorite observations about asset allocation: “It’s not the variance you have to worry about, it’s the covariance.” In other words, you can hold plenty of risky assets with high expected returns as long as they fluctuate independently rather than in step with each other.

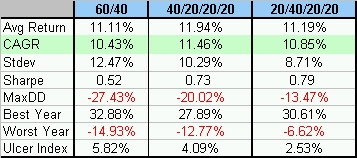

Here is an example. Below is a table for a standard 60/40 allocation since 1972 (S&P500 and 10 Yr US Govt Bonds). Following Swensen’s lead, we reduce the stock and bond exposure by 20% each, and add two riskier (more than double the volatility of bonds) asset classes at 20% each – REITs and commodities. Notice how the return improved and the risk declined, all due to the assets being uncorrelated. We then take 40% off the original stock position, and distribute it to REITs and commodities evenly at 20% (S&P / Bonds / REITs / Commodities).

What would an Endowment Portfolio formed from publicly traded vehicles look like? I have written extensively on the endowment method of investing before. Below I list 10 world betas followed by the alternative holdings. The percent weightings are in the ballpark of the Harvard and Yale endowments. Only one fund is foreign listed (the private equity portion), because there is no US equivalent (I don’t like PSP). Consequently, one could use any of the myriad foreign listed funds of funds as well (Goldman, Dexion, Alternative, etc.).

There are lots of ways one could tweak this portfolio . ie using leveraged ETFs to port alpha from the alternative funds, etc. . .

I would like to hear your comments on the allocation. . .