(Note: Original table is corrected, thanks for the heads up)

CBOE just introduced a new PutWrite index to complement their BXM covered call strategy. I imagine this data would be A LOT different had the start date been one year prior (instead of the Summer 1988 date they use).

I have blogged about options writing before, and here is an update of an artificial options selling FOF. I wouldn’t invest in one of these funds, but if I HAD to, I would examine 2 ways to gain exposure.

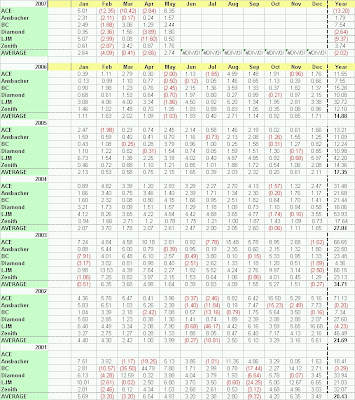

1. Create a FOF of option sellers. This should help to minimize impact of any one fund blowing up. However, since most funds only trade one market, large risks remain. The performance of a an equal-weighted basket of these funds is in the below table as “AVERAGE” – and you can see the performance has been deteriorating.

2. Sell options on a broad portfolio of world futures markets. Only one fund to my knowledge (and only recently) has pursued this strategy (ACE). Selling options on a broad basket of uncorrelated futures markets makes more sense to me than one single market. I did a simple backtest of this strategy a few years back, and the results were promising.