I started out my undergraduate at the University of Virginia in Aerospace Engineering. After a year or so in that track (and a summer internship at Lockheed where all I did was play on the corporate softball team), I decided that aerospace was definitely not for me. (My childhood astronaut fantasies certainly were not the same as studying statics and dynamics.) In one of those small insignificant instances that changes your life forever, I was browsing an isle at a bookstore in Boulder, and come across James Watson’s “Recombinant DNA” textbook.

I was floored, and spent the rest of my Summer taking courses in genetics at Colorado (and flying lessons while working as a carpenter – could life get any better? Not to mention living with three girls). When I returned to UVa, I ended up majoring in Biology and Engineering, and focusing all my studies in gene therapy and genetics. Wiki gene therapy primer here.

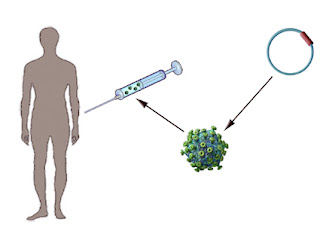

I dove head first into every genetics course the school offered, and worked in a lab that was attempting to develop a virus to protect the heart against heart attacks. The biggest problem in gene therapy then (and now) was delivering the gene to the right place, and getting it to express (produce) the protein. We were never successful – and after spilling our prized virus all over the lab and the resulting two hour cleanup that entailed, I realized bench work was not for me.

I took some grad courses at Hopkins, but after many warnings from my brother who did the 8-year PhD plan, I compromised and became a biotech equity analyst. The best strategy for investing in gene therapy stocks since that time has been to short everything you can (and then borrow money and short some more). The gene therapy field has been a black hole for investor $.

However, there are beginning to be signs of light at the end of the tunnel. Recent new of a Parkinson’s disease trial has been quite encouraging. (Article in the Lancet here.) The company mentioned in the article, Neurologix, is a tiny $30M publicly traded biotech that popped 50% on the news (NRGX).

Biotech, more so than probably any industry, is driven by potential and hope. At the end of the day, and investor still must be able to develop a discounted cash flow type of model to justify valuations. One of the biggest problems in biotech, however, are the binary outcomes of many of the drug trials. To deal with this characteristic, I use risk adjusted net present value models – rNPV for short. It helps to account for the cost, risk, and time inherent in product development. Instead of going into a long discussion of the method, here are a few links of interest:

Biotech Valuations for the 21st Century

Putting a price on biotechnology

Milken Institute rNPV Excel spreadsheet

BioGenetic Ventures rNPV Excel spreadsheet

What’s a Drug Worth – Motley Fool article

If there is sufficient interest from readers, I can do an example rNPV for one of the early stage biotech companies like GNVC or NRGX.

PS It must be nice to be married to a billionaire to fund your new genetic information company. One of the needs in the marketplace, in my opinion, is an information service that delivers the Amplichip to the consumer (it measures variations of two genes that determine how fast you metabolize certain drugs). Seriously, if I was on any sort of antidepressant or anti psychotic (or knew someone that was), I would make it mandatory to take the test before deciding on a dosage.