When the best hedge fund on the planet decides to launch a new fund, it bears watching. Even more interesting is the area Rentech has decided to pursue. The full press release is at the end of the post, and below are my comments as there seems to be a great deal of misunderstanding in the commodities and managed futures space.

On one side there are the almost religious-like proponents of managed futures – dominated by long term trendfollowers who exclaim mantras such as, “The trend is your friend until it bends in the end”. On the other side there exist skeptics that believe the returns are simply survivor bias in a random process. I fall somewhere in the middle, and in my opinion, this is a great example of trying to understand the drivers of a relatively simple strategy.

I have touched on commodities on the blog before:

Q&A with Harvard’s El Erian

Q&A with Bob Greer from PIMCO

. . .and managed futures on the blog before:

Managed Futures…Finally (a review of RYMFX and good background info)

Out of Sample Results and Price Shocks

Hulbert Trendfollowing Article

Some more background reading from the academic literature:

“Commodities and Real-Return Strategies in the Investment Mix”, David Burkhart,(CFA Quarterly conference proceedings)

“Facts and Fantasies about Commodity Futures“, Gorton and Rouwenhorst

“The Strategic and Tactical Value of Commodity Futures“, Erb and Harvey

“Evaluating a Trend-Following Commodity Index for Multi-Period Asset Allocation”, Mulvey, Kaul, and Simsek

I don’t want to repeat what these authors can convey much better than I can (especially the Erb Harvey paper), but below is a quick discussion of the return drivers for commodities and managed futures.

(Again, for a full treatment read the academic papers above.)

Commodity Long Only Returns

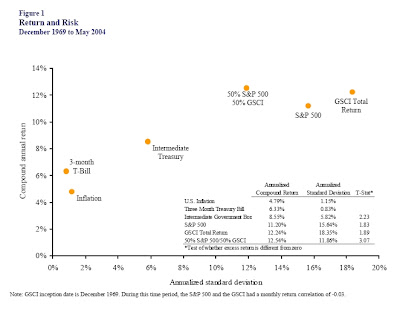

Readers of the blog are aware that I am a huge fan of commodities (and that is not just because half my family comes from farming and we are happily growing wheat currently). In my recent paper, “A Quant Approach to TAA“, I had a full 20% allocation to commodities. Since commodities are real assets (i.e. wheat, gold, oil), they have different sources of return than stocks and bonds. (And I love the fact that none of the gurus have ANY allocation to commodities.) In addition, commodities have a low correlation with these asset classes and are a good hedge against unexpected inflation. Historical returns to commodities have been in-line with stocks, with similar volatility. (Although it is important to note that all of the commodity indices have some backfill bias.) Chart below from the Erb paper.

But will those returns continue in the future?

The return to commodities can be explained as the following:

Commodity Portfolio Total Return = Cash Return + Excess Return + Diversification Return

Cash return comes from only having to place 10% margin down on futures contracts, and the rest (or all) sits in T-Bills.

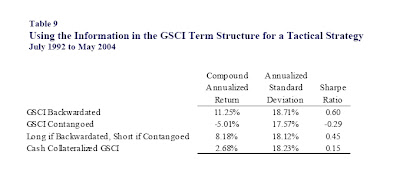

Excess return is the change in the price of the futures contract. This will be due mainly to roll yield. When a commodity is backwardated (i.e. current futures price is higher than further futures price), there exists a roll yield from holding the out futures contract. Historically roll yield has been ~ 2.5% for the GSCI, but has been declining. Energy markets are typically in backwardation, although the GSCI has been backwardated as often as it has been in contango. The bottom line is that roll returns are the expected price of insurance. From the Erb paper:

De Roon, Nijman and Veld (2000) analyze twenty futures markets over the period 1986 to 1994 and find that hedging pressure plays an important role in explaining futures returns. Anson (2002) distinguishes between markets that provide a hedge for producers (backwardated markets), and markets that provide a hedge for consumers (contango markets). He points out that a commodity producer such as Exxon, whose business requires it to be long oil, can reduce exposure to oil price fluctuations by being short crude oil futures. Hedging by risk averse producers causes futures prices to be below the expected spot rate in the future. Alternatively, a manufacturer such as Boeing is a consumer of aluminum, it is short aluminum, and it can reduce the impact of aluminum price fluctuations by purchasing aluminum futures. Hedging by risk averse consumers causes futures prices to be higher than the expected spot rate in the future. For example, Exxon is willing to sell oil futures at an expected loss and Boeing is willing to purchase aluminum futures at an expected loss. The losses incurred by the hedgers provide the economic incentive for the capital markets to provide price insurance to hedgers. Both of these examples highlight a view that commodity futures are a means of risk transfer and that the providers of risk capital charge an insurance premium.

Diversification and Rebalancing return (historically about 2-3%) is simply due to the reduction in variance from diversified portfolios (known as variance drain or volatility gremlins). The three main commodity indices have varying returns, and that is due the differing weightings. GSCI invests in 24 contracts (production weighted so it is heavy in energy), DJ AIG invests in 20 (based on production and liquidity), and the CRB invests in 17 (equal weighted).

Managed Futures Returns

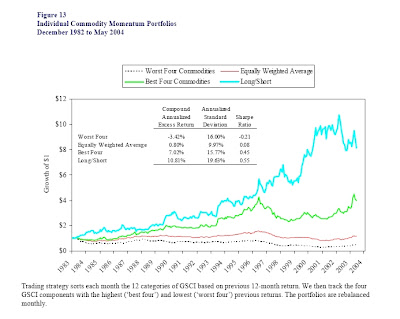

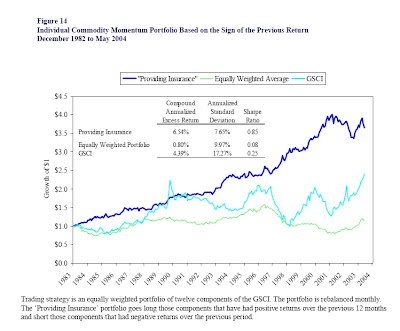

Managed futures typically take advantage of two strategies. The vast majority employ a momentum, or trendfollowing approach. As I detailed in my paper, “A Quant Approach to TAA“, applying a momentum based approach results in similar returns with a decrease in volatility. A trendfollowing approach in managed futures likely gets an additional performance boost from this characteristic, in addition to the extra diversification return of non-correlated long and short positions. Here are two charts from the Erb paper for simple mo approaches :

The minority apply a term structure approach. Below is a simple strategy of going long the GSCI when backwardated and short when contangoed (again, from Erb):

With many of the trendfollowers getting crushed lately, maybe Rentech is picking a great entry point into the field? I like to have a tactical approach to the asset class as a whole, and then supplement that with an exposure to managed futures.

Some symbols:

iShares GSCI Commodity-Indexed Trust ETF (GSG)

iPath Dow Jones-AIG Commodity Index Total Return ETN (DJP)

iPath S&P GSCI Total Return Index ETN (GSP)

PowerShares DB Commodity Index Tracking Fund ETF (DBC)

PowerShares DB Agriculture Fund ETF (DBA)

Rydex Managed Futures (RYMFX)

By the way, this quote from the press release is completely incorrect:

“Managed futures, a type of hedge fund strategy that was originally commodity trading, traditionally works best at times of high market volatility because it arbitrages tiny price differences. “

—————————————————————————

Renaissance to launch new fund

By Deborah Brewster in New York

Financial Times

Renaissance Technologies, one of the world’s biggest and best performing hedge fund groups, plans to launch a managed futures fund with a capacity of $25bn, an unusual foray into an investment strategy that has been underperforming.

Renaissance was founded by former maths professor James Simons, last year the world’s most highly paid hedge fund manager, earning $1.7bn.

The group’s flagship $6bn Medallion fund, which trades in a lot of futures, has been quickly overtaken in growth by its newer Renaissance Institutional Equities Fund, which was launched two years ago and trades only in stocks. The Institutional fund, which was designed to hold $100bn, already manages $26bn. It charges much lower fees than Medallion’s notoriously high 44 per cent performance fee, and was designed to provide lower volatility and a lower trading turnover, appealing to pension funds.

Investors in Medallion last year received returns of more than 40 per cent, and investors in the institutional fund received more than 20 per cent, after fees. The Medallion fund now contains mostly Mr Simons’ own money and that of Renaissance employees.

Managed futures, a type of hedge fund strategy that was originally commodity trading, traditionally works best at times of high market volatility because it arbitrages tiny price differences. Managed futures funds have not performed as well as other strategies in the past few years because markets have had low volatility.

In the year to date, managed futures funds returned an average of 4.2 per cent, compared with 8.9 per cent for hedge funds in total, according to the Credit Suisse/Tremont hedge fund index. There have been few such new funds launched recently.

Like most of the largest hedge fund firms, Renaissance is a quantitative investor, developing complex mathematical models for its trading strategies. Mr Simons has said that his group hires no-one from Wall Street, but instead seeks out astronomers, mathematicians and physicists.

Copyright The Financial Times Ltd. All rights reserved.