I like to use Portfolio123 for my quant based stock models. It is cheap compared to the likes of Factset, and easy to use. The biggest drawbacks are the limited database, which only goes back to 2001, and the inability to build short models.

I like to use Portfolio123 for my quant based stock models. It is cheap compared to the likes of Factset, and easy to use. The biggest drawbacks are the limited database, which only goes back to 2001, and the inability to build short models.

The main model I track has about 25 factors, including measures of valuation, momentum, liquidity, risk, and operating performance. I could list all the factors here, but I believe it to be more instructive to go into the software and play around for awhile. You may find some unexpected factor behavior that contradicts what you hear in the media.

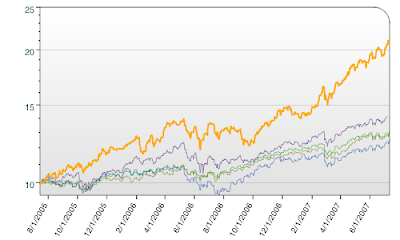

I have been tracking a simple monthly update of the ranking system on Marketocracy, which you can view here. The equity curve (orange) is below vs. various stock indices:

The top 20 ranked stocks (over $50M) in my model are as follows (bold is highest rated):

ARW

AVT

BW

CFK

CMC

EASY

GLP

GPX

ICOC

PENX

PKOH

RCMT

SMP

SMTX

SRI

SYNL

TEAM

TESS

VLO

WMCO

The interesting part about these simple quant models is that they pick the same stocks as the large quant funds. For example, TESS is held by LSV, Rentech, Numeric, Bridgeway, and Laudus.

The software also lets you view the mostly widely held stocks in user’s portfolios. The top 10 currently are:

BPHX

SMTX

CNRD

SGU

ISH

AVT

VLO

OPY

PNCL

ABM

{As an aside, I don’t really get Covestor or VesTopia – but would like to hear your comments. It seems like an exercise in survivor bias, but I could be wrong. . .}

Barron’s also published an interview with John Montgomery, founder and President of the quant-based Bridgeway mutual funds (I am a big fan). Their top 10 holdings are:

BIG

GES

MDR

CROX

AMX

AVT

VSEA

AAPL

BMY

TDY

AVT is present on all three lists.