A recent article in the WSJ, “Why Harvard is Smarting“, takes a look at a hedge fund investment gone bad. I have blogged numerous times on the outstanding track records of the top university endowments, Harvard and Yale. (You may also want to check out a similar previous post on comparing a simple asset allocation to the hedge fund indices.)

A recent article in the WSJ, “Why Harvard is Smarting“, takes a look at a hedge fund investment gone bad. I have blogged numerous times on the outstanding track records of the top university endowments, Harvard and Yale. (You may also want to check out a similar previous post on comparing a simple asset allocation to the hedge fund indices.)

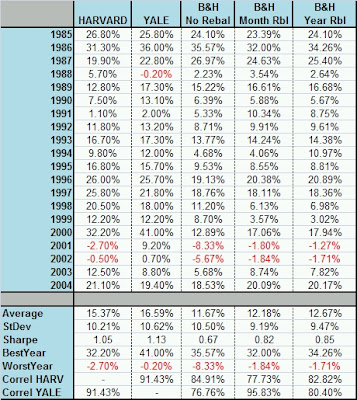

In an update to the seminal text on asset allocation, Darst adds a new chapter (the 2nd) in his book on the endowments. I decided to update some tables with side-by-side performance of the endowments vs. a general asset allocation portfolio, all with fiscal year end of June 30th.

Also, with all the chatter on the pros and cons of rebalancing, I included various rebalancing periods. No fees, taxes, or commissions are deducted.

The first table below shows that the endowments generate about 400 bps of alpha over a standard asset allocation (20% each in the S&P500, MSCI EAFE, 10 Yr US Govt Bonds, NAREIT, and GSCI). All are total return series. It looks like rebalancing produces the best returns at the yearly time frame. (Although not listed, the drawdowns are roughly half that of the non-rebalanced.) So does it make sense to rebalance? Likely, but with tax and cost considerations in mind.

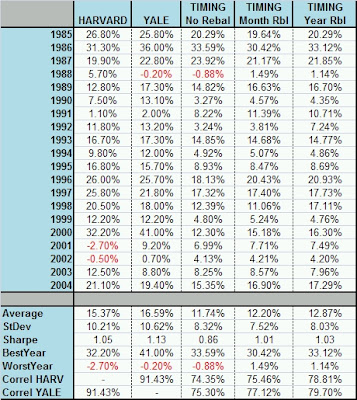

How about the timing model, what is the ideal rebalance period? Again, yearly looks to be best, and does a fine job of approximating the risk-adjusted returns of the endowments.

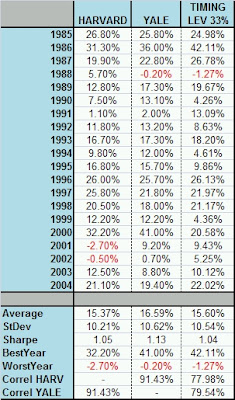

To target similar returns of the endowments (who invest in alternatives that use leverage), we examine the yearly rebalance leveraged by a third (at commercial paper rates) and find that the results are near identical to the results of Harvard, but still lagging Yale by about 100bps.

Example ETFs of asset classes mentioned in the article are SPY, EFA, AGG, IYR, and GSP.