After recent market action, I feel like quoting Borat from humor school.

“Market neutral funds are market neutral . . .NOT!”

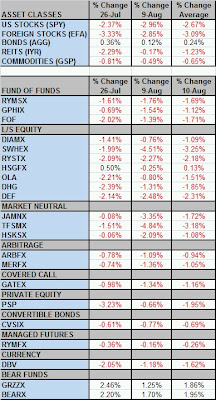

A table of the listed “alternatives” is below. The arb funds (convertible and merger) and managed futures had respectable down days compared to the other funds, while holders of market neutral TFSMX are smarting after a near -5% dump.

A quote from a letter from TFS Capital:

“TFS Capital’s long short investment funds have suffered large losses so far this month. This MarketWatch story describes similar hedge and mutual funds that have performed similarly in recent days. The story provides insight into what may be causing this situation and what others think may happen in the future.”

In other words, everyone else is doing bad so don’t blame us for the 15% drawdown we are in. All the market neutral and l/s quants design a factor based model, and they’re all pretty similar (and for an OUTSTANDING discussion check out Haugen’s books “The New Finance” and especially “The Inefficient Stock Market“). They buy the top decile, and short the bottom decile, and you can see the herding when you look at the top holdings of the funds. Many funds include momentum as one of the factors as well.

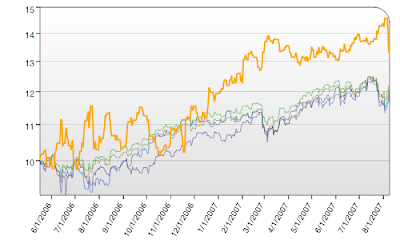

One of the difficulties for these funds is when the rankings invert – the top decile performs the worst, and the bottom decile the best. I track a couple generic quant ranking systems on Marketocracy. Below, you can see that the long portfolio has done well, and the short portfolio has likewise done better than the overall market. But if you look at the recent action, BOTH the long and short portfolios are losing money – a classic inversion and what is likely killing all the MN and L/S funds. . .

LONG PORTFOLIO

SHORT PORTFOLIO

As an aside, the UK listed hedge funds are not immune to the recent market action. . .Some background on Alternative Investment Strategies and Dexion Absolute.

Charts for:

Goldman Sachs Dynamic Opportunity Fund (GSDO.L)

Dexion Absolute (DAB.L)

HSBC Global Absolute (HSBC.L)

Atlin AG (AIA.L)

Alternative Investment Strategies (AIS.L)