“Knowledge is good” – Emil Faber, founder of Faber College

“Knowledge is good” – Emil Faber, founder of Faber College

While I have no idea how my namesake college endowment is performing these days, Harvard Management Company just released their fiscal year 2007 results, and they are fantastic. From the article:

The Harvard endowment grew 23 percent during the fiscal year, which ended June 30, swelling to a new high of $34.9 billion, the Harvard Management Co., which oversees the university’s endowment, said yesterday

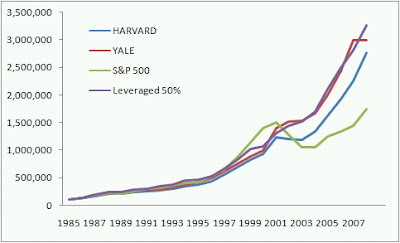

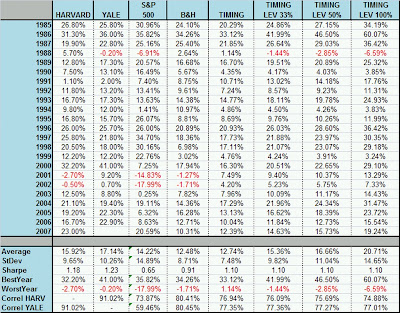

Below I have updated the Endowment vs. Buy-and-Hold vs. Timing approaches for the 2007 year. If anyone comes across the HMC or Yale endowment reports, please pass them along and I will update the charts as well.

Remember, the fiscal year for the endowments ends June 30th, therefore all of the figures are for fiscal year end (and will not match calendar year end).

Both Harvard and Yale have hit the ball out of the park for the past few years, no doubt aided by the massive amounts of deals going on in private equity. It is interesting to note that the endowment return streams are ~90% correlated, and both have a high correlation with a simple buy and hold of five asset classes (what we call the endowment portfolio, or 20% each in US stocks, foreign stocks, bonds, reits, and commodities).

Even with the Sowood $350M mess Harvard managed to eek out a .4% return for July.

Applying a simple timing system, and leveraging the portfolio roughly 50%, an investor could have achieved results eerily similar to the endowment track record. Both the 50% leveraged timing and the Yale endowment would have only had one negative year – 1988.

No taxes, commissions, or management fees are charged to the active portfolios, and they are rebalanced yearly. 90-Day Commercial Paper is used for borrowing costs. The Sharpe Ratio uses 4.54%.

Representative ETFs mentioned in this article could be:

US Stocks: VTI, SPY

Foreign Stocks: EFA, EEM

Bonds: IEF, AGG

REITs: IYR, RWX

Commodities: DBC, GSG