Is it time for the Old Guard to disappear into the sunset?

I blogged in July about the news Rentech was planning on moving into the managed futures space in a big way. Talk about good timing – since that time many of the largest futures funds have been hemorrhaging money.

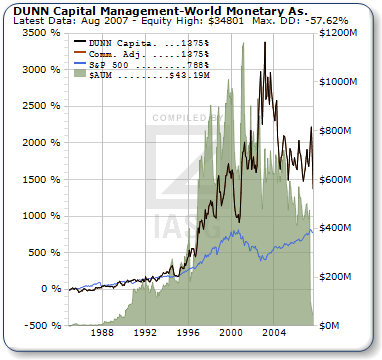

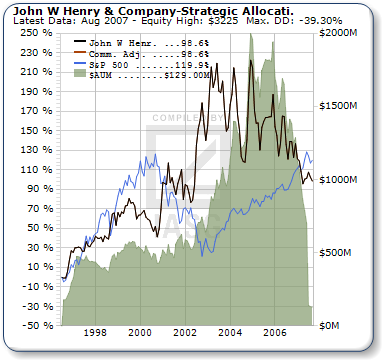

Two of the oldest and most famous managed futures managers, Dunn and Henry, are getting pummeled this year. Dunn is in a 40%+ drawdown the past two months, and is down 4 of the past 5 years(5 negative years in the combined futures programs) with AUM shrinking to near zero. Charts courtesy IASG.com.

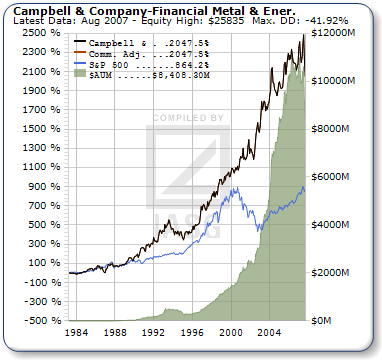

Campbell is in its largest drawdown in 13 years (albeit only ~17%).

Chesapeake is down over -20%, Superfund over -25%, Mulvaney -35%, and Henry hasn’t had a positive year in some of his programs since 2002! Spending too much time watching the Red Sox?

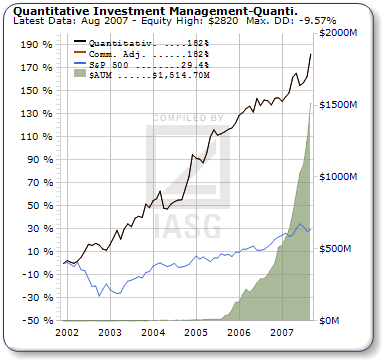

Ok, who is having a good year? The Rydex Managed Futures (RYMFX) fund is up slightly since it launched about 6 months ago (and Greg Newton examines the fund in his article “Correlated With Nothing At All“). Quantitative Investment Management (run by some fellow Virginia alums) is up 17% with no down years since inception:

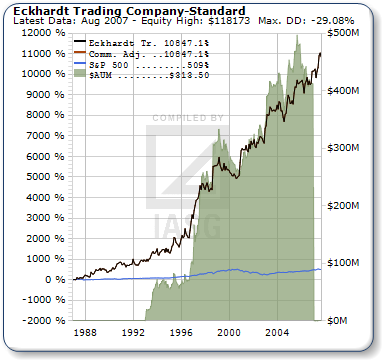

Eckhardt is up ~6% and hasn’t had a down year since 1999 (And Covel’s new book should be shipping in the next month – a 2nd perspective on the famous Turtle experiment):