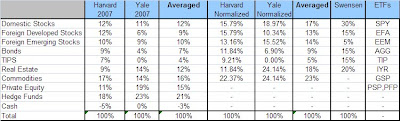

I updated some tables with the new Yale 2007 endowment report. One could invest in a weighted portfolio of ETFs for less than 40 bps. Yale doesn’t break out their real assets category, so I divided it evenly between real estate and commodities. Even though Swensen doesn’t recommend commodities explicitly, the endowment does invest in oil and gas partnerships – and the GSCI is essentially an energy index. . .

(Click on the table for a larger table.)

Here is a look at how the Yale endowment has changed over time, and if you’re interested, here is a longer academic look at the differentiators of endowment performance:

In conclusion, if you are an endowment manager do not try to copy the Harvards or the Yales of the world. In fact, we looked at what consequences such herding behavior would have: implementing passively the asset allocations of the top 25, 10 or even 5% performers produces a portfolio whose returns rank in the bottom 30-40% of the endowment universe. Instead, focus on those asset classes where your alpha generating capabilities are best. This doesn’t necessarily mean mean that you should take more risk, or that you should even increase your exposure to alternative investments. It only means that you would likely be best served by focusing more on what you know instead of on the accepted norm. At the end of the day, this is really very basic and reasonable advice.

—-

—-

Here is a link to the “Turtle” questionnaire of Dennis/Eckhart. Does anyone have the Tiger questionnaire that Robertson & Dr. Stern used?

—-

And just in time for New Year’s Eve, red fluorescent cats!

—-