Invest when Congress is in session? Don’t make me laugh. . .

Invest when Congress is in session? Don’t make me laugh. . .

Congress in session (Link to original post here.)

Here is a website that lists when Congress is in/out of session.

The Congressional effect varies systematically with stock investors’ (dis)approval of Congress – returns are lowest and vol highest when Congress is in session with low approval ratings.

Here is a website that lists the 22% of people that approve of Congress. (Average approval is ~41%.)

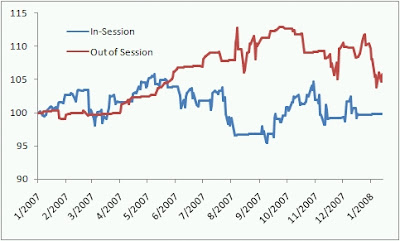

The return of investing when Congress was out of session would have beaten the in session for 2007:

—-

Largest Mkt Cap (Link to original post here.)

XOM sure put a hole in that theory for 2007 with a return of 24%. Exxon keeps the title of largest US company for another year.

—-

Also, a great new paper out, “Do Professional Currency Managers Beat the Benchmark?“.