Feel like the Big Bear is hiding somewhere? If you’re the Nasdaq, he is only 1% away. . .(Painting is “Doubled Back” by Bev Doolittle. If you don’t see the bear, click on the picture to open it in another window.)

While domestic and foreign stocks have been getting hit hard in 2007, bonds (relatively) and commodities have been performing nicely. There is probably more misunderstanding of commodities as an asset class than any other, and I have written extensively on the subject in the past on World Beta (Links here, here, and here).

The much promoted Great Commodities Debate Part I and II here) showed that the participants have a good understanding of commodities. However, I found it very strange that there was no mention of managed futures or a tactical approach – either long/flat or long/short. Maybe they could have a Part III of the debate and include Victor Sperandeo, author of the new book “Trader Vic on Commodities“.

I still take issue with some of the designs of the DTI (ie energy long only due to “risk factors”). He does presents data on a long/flat timing model on the S&P500 very similar to my own(with more data) – it is good to see confirming results.

—-

Harry Kat on a follow up to Jaeger’s alternative beta post:

“Based on the analysis above, it seems the Alternative Beta approach may sound better on paper than it does in practice. It confirms what econometricians have known for a long time: complex models often perform worse than simpler ones. It was for exactly this reason that Albert Einstein (or was it his wife Mileva?) recommended that models should always be kept as simple as possible.”

—-

Great quote from the just arrived book Optimal Portfolio Modeling:

“Play the game with more than you can afford to lose…only then will you learn the game.” – Winston Churchill

—-

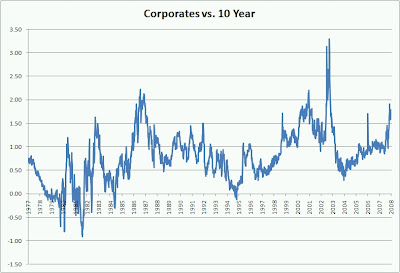

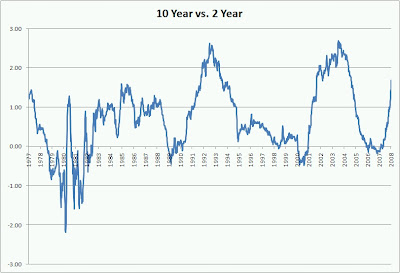

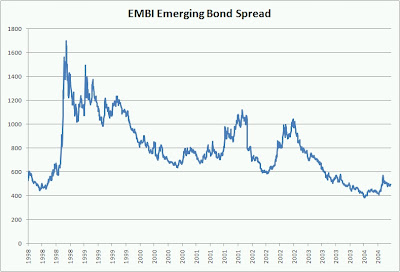

Last Summer would have been a great time to buy volatility and risk and buy bond spreads. My approach to these types of trades is simple. Buy them when they are at historically low levels, and short them when they get to high levels. As Julian Robertson recently mentioned this Fall, his favorite trade was a curve steepener (long two-year, short ten-year). Looks like he is printing money on that one.

As Bespoke points out, corporates are getting near historically high spreads vs. Treasuries (although my data shows the spread spiking to above 300 bps) , so one could short that spread soon. Although it seems like we have been crisis free in the emerging markets for quite some time – and spreads are at historically low levels. Time to buy the emerging bond spread?

Below is a chart of the 10 year vs. 2 year spread, followed by the Corporate vs. 10-Year spread, followed by the Emerging bond spread.