I believe avoiding loss is the most important consideration in this business. But don’t take my word for it – below are a few of my favorite quotes on investing (& losing), by some of the top investors in the world.

“The first rule is not to lose. The second rule is not to forget the first rule.” – Warren Buffett

“Whenever I buy or sell something , I always try and make sure I’m not going to lose any money first … my basic advice is don’t lose money. ” – Jim Rogers

“A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does damage to the pocketbook and to the soul.”

-Jessie Livermore in “Reminiscences of a Stock Operator”

“I am always thinking about losing money rather than making money.” Paul Tudor Jones

I published a paper last year to focus on the topic in the title of this blog post – “A Quant Approach to TAA“. It took inspiration from the Policy Portfolios of the Harvard and Yale endowments to come up with a simple strategic asset allocation – 20% each in US Stocks, Foreign Stocks, US Government Bonds, REITs, and Commodities. This portfolio can be easily implemented with low-cost ETFs or mutual funds, and rebalanced every so often. It then applied a smiple tactical overlay to reduce risk and drawdowns – ie winning by not losing. This technique would have had you out of US Stocks the end of 2007, out of Foreign Stocks the end of January, and out of REITs way back in June of last year. And of course you would still be happily in 20% bonds, 20% commodities, and 60% cash.

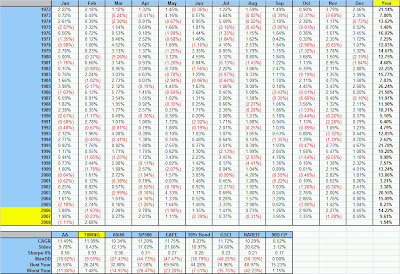

I have received a handful of emails asking to post the monthly return series online, and below is a PDF you will have to click on to enlarge and view. As you can see, the returns in 2006 (when I first circulated the paper) to 2008 out-of-sample are quite representative of the previous 30+ years. 36 profitable years and counting – including this year (so far), a pretty difficult year for those who are long stocks. (All figures below are gross of any management fees, commissions, taxes, or bid/ask spreads. The original paper also understated the cash returns a bit and is corrected here.)

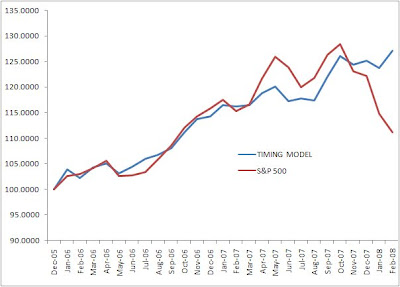

And at the request of a reader – returns since 2006: