I posted awhile back on the question of who spawned more impressive offspring, the Turtles of Eckhardt/Dennis or the Tiger Cubs of Julian Robertson? (I should have also added Commodities Corporation that includes offspring Ed Seykota, Michael Marcus, Paul Tudor Jones (Tudor), Bruce Kovner (Caxton), Louis Bacon (Moore Capital), Jack D. Schwager and Peter Brandt. Some of the alumni:

Tiger Cubs:

Lawrence Bowman – Bowman Capital

Steven Mandel – Lone Pine Capital

Lee Ainslie – Maverick Capital

John Griffin – Blue Ridge Capital

Andreas Halvorsen – Viking Global

Tom Brown – Second Curve Capital

Quinn Riordan – Elmwood Advisors

Paul Spieldenner – Bamboo Capital

Tom Facciola – TigerShark

Bill Hwang – Tiger Asia

Dwight Anderson – Ospraie Capital

Chase Coleman – Tiger Technology

Kevin Kenny – Emerging Sovereign

Patrick McCormack – Tiger Consumer

Paul Touradji – Touradji Capital

Bjorn Rise – Oceanic Energy

Turtles:

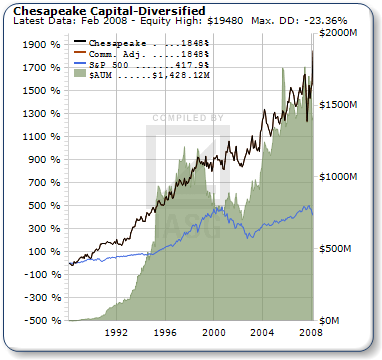

Jerry Parker – Chesapeake Capital

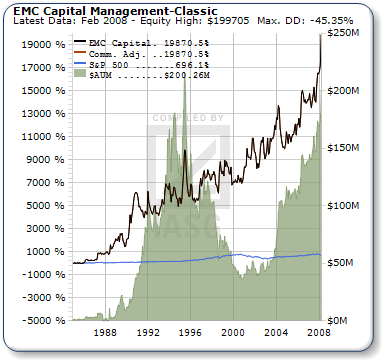

Liz Cheval – EMC Capital

Jim DiMaria – JPD

Curtis Faith – Former Trading Blox, now The State We’re In

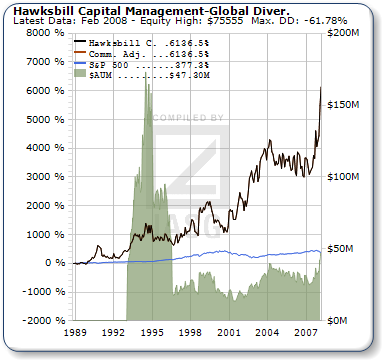

Tom Shanks – Hawksbill Capital

Mark Walsh – Mark J. Walsh Co.

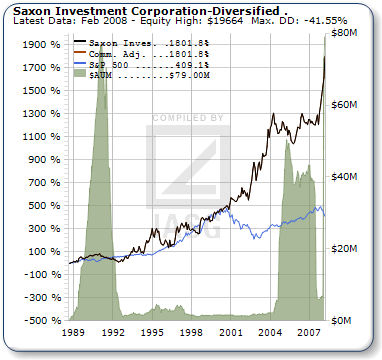

Howard Seidler – Saxon Investment

Paul Rabar – Rabar Market Research

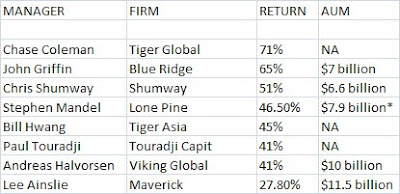

Looks like a great year in 2007 for the Cubs. From Bloomberg:

Robertson is not doing too bad himself. These funds tend to often own similar stocks, and gives quite a bit of validity to the hedge fund consensus and best ideas strategies that outperformed the markets by about 10% in 2007 (out of sample). And the alphaCLONE concept coming up.

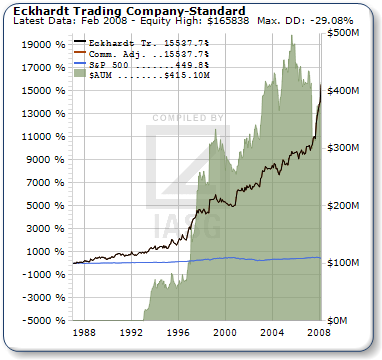

How about the Turtle progeny? Having a huge 08 (from IASG):