If anyone is attending the Dresdner Kleinwort Listed Hedge Fund Conference in London on April 30th, please let me know how it goes (and pass along any good materials).

—-

Arnott takes his case to the masses: The Fundamental Index: A Better Way to Invest.

—-

“…I know about random walks, and when you draw these charts every day, after a bit you think, “That is no random walk.” All the university professors will say, “Well, if you watch the charts for a thousand years, that’s what it is.” Physicists, however, are not like mathematicians. They are empiricists. They study the world; they study data.

Mathematicians can be satisfied with the purely theoretical. I became convinced that markets a) weren’t efficient and b) absolutely trended. Later on, when people were able to back-test these theories, that turned out to be true. How do you harness this to make money?

We trade everything using trend-following systems, and it works. By simulation, you come up with ideas and hypotheses, and you test those. Over the years, what we’ve done, essentially, is conduct experiments. But instead of using a microscope or a telescope, the computer is our laboratory instrument. And instead of looking at the stars, we’re looking at data and simulation languages. It’s a very tricky field. It’s fraught with potholes and tricks. It’s treacherous. The more you get into science and the more you talk to scientists in other fields, the more you find out it’s all kind of like that”

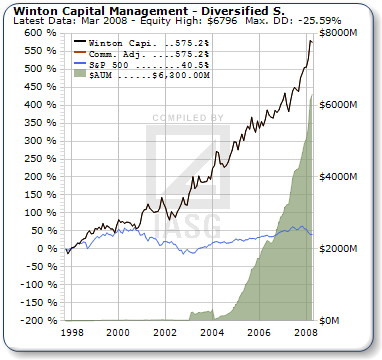

Just how well does it work? 20% a year with no down years. Chart via IASG.com: