Posts have been light due to all of my traveling (and flights getting canceled). I hope to catch up later this week. Although I forgot how much I love NYC (even when it is rainy and nasty like it is right now). One of these days some one will figure out why the pizza here is so much better than in LA.

—-

Sat down with the Mark Yusko in Chapel Hill (he used to run the UNC endowment). Lots of moving parts at his firm Morgan Creek, who manages the Endowment Fund (Salient), the Hatteras Funds, and the Tiger Select Funds. I think their late stage VC fund is pretty interesting.

—-

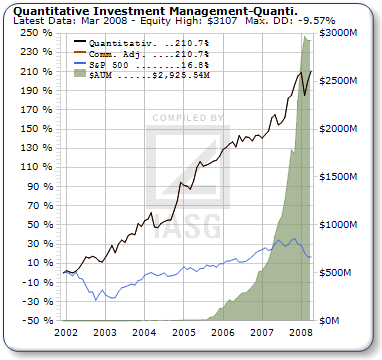

Also sat down with the manager of Quantitative when I was in Charlottesville. Jaffray is one of those people I could talk to for hours – extremely interesting. Not a bad equity curve either (from IASG):

—-

I am not sure why Lehman wouldn’t launch a foreign listed hedge fund (or private equity) ETN first, but here is a copycat private equity ETN. I wonder if the ETN structure will get around the foreign listed funds getting taxed as current income?

—-

Lots of different commodity indexes.

—-

Nice day for hedge consensus and best ideas holding Mastercard (MA). Third Point, Marsico, Viking, Tiger, Ruane Cuniff, Lone Pine, Atticus, Bridger, Blue Ridge, Heebner, and DE Shaw all owned it as of the last 13F.

—-

If you have nothing else to do, a paper from the Journal of Psychoanalysis.

—-

Longleaf, Dodge and Cox, and Sequoia are all reopening.

—-

I wish they offered this class when I was at Virginia. In an unrelated note, they just dedicated a building to Julian Robertson this past weekend led by head donor John Griffin (Blue Ridge Capital).

—-

I picked a bad week to leave LA – the Milken conference looks pretty interesting, and even has a panel on Econoblogging. At least most of the content is online.