I don’t really get Kedrosky’s post on 300 point rallies in bear markets (as a follow up to Ritholtz). The point value is not useful in comparing current conditions to past conditions. As an example, a 300 point move on the Dow now equates to about a -2.5% loss. Back in 2002 or 2003, that is closer to a -4% loss (and early 1990s that is a -10% loss, and in the 1920’s it is a -100% loss), but you get the picture.

A better question is:

Does the Dow experience its largest gains and losses in up or down markets?

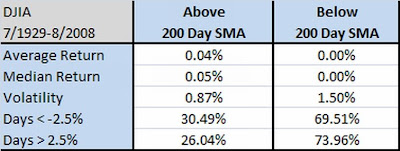

As I posted previously (and the original post here), volatility is much higher and returns lower when the stock market is declining (as measured using something simple like a 200-day moving average or 10-month moving average).

But it looks like David Rosenberg of Merrill is correct, most of the big days come when the market is under the moving average. About 65% of the time (since 1929) the DJIA is above the 200 day simple moving average (this is using Yahoo data). That makes sense, markets go up a majority of the time.

However, take a look at the table below.

The following conclusions can be drawn:

1. The market returns, on average, are much higher when the market is in an up trend.

2. The market volatility, on average, is significantly higher when the market is in a down trend. (Those vol numbers anualize to about 13.8% and 23.8%, respectively.)

3. The largest moves in both directions occur when the market is in a downtrend.

Note: #3 is due to #2, a point most people miss. The bigger moves occur because the market is more volatile – namely because people are scared. Going back to this great presentation from Andrew Lo, people use different parts of their brain when the market is declining. If you see people lining up at IndyMac across the street like I did a couple weeks ago, you are probably going to be a little more irrational than when your Chinese ETF is hitting new highs.

This is the main reason my timing model works. It sits out the times when markets return less and are more volatile. Nothing earth shattering, but it does buy you peace of mind.