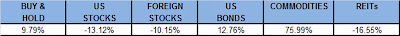

Estimates for returns for the fiscal year ending June 30th, 2008 are around 7-9%. Pretty impressive considering stocks were down more than -10% over the same time period. Below is a table of the five main asset classes over the past year and their total returns. The buy and hold allocation is the same allocation mentioned in my paper, namely a 20% allocation to the same five asset classes. No rebalance over the time period.

Click on the table to enlarge.

One could replicate these asset classes with the following ETFs:

SPY

VEU

BND

VNQ

DBC

—-

“Tactical Allocation in Commodity Futures Markets: Combining Momentum and Term Structure Signals” by Ana-Maria Fuertes, Joëlle Miffre and Georgios Rallis.

As usual, CXO offers up a great overview of an academic paper:

In summary, commodity futures trading strategies that combine momentum and roll return may offer strong performance largely uncorrelated with those of stocks and bonds.

How long until we see a roll return-momo managed futures ETF?