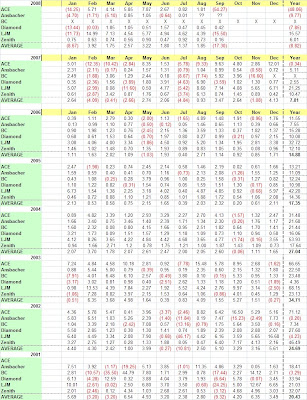

Back in March of 2007 I wrote about how the option selling funds were a blowup waiting to happen. Below is an update of their “performance”.

The time to invest in these funds is when the VIX is at all times highs (now, 70s) rather than all time lows of around 10 a number of months ago. Although I wouldn’t invest in one of these funds at all, but if I HAD to, I would examine 2 ways to gain exposure.

1. Create a FOF of option sellers. This should help to minimize impact of any one fund blowing up. However, since most funds only trade one market, large risks remain. The performance of a an equal-weighted basket of these funds is in the below table as “AVERAGE” – and you can see the performance has been deteriorating.

2. Sell options on a broad portfolio of world futures markets. Only one fund to my knowledge (and only recently) has pursued this strategy (ACE). Selling options on a broad basket of uncorrelated futures markets makes more sense to me than one single market. I did a simple backtest of this strategy a few years back, and the results were promising.

Anyone wanna guess how many of these funds make it through October?

Click on the chart to enlarge: