(Posting will be a little lighter over the next few weeks as I have a broken hand. Well, at least until I can get the Dragon dictation software installed.)

Great interview with Bruce Berkowitz and Steve Forbes (HT: BA). Fantastic discussion about holding a concentrated portfolio of stocks. I thought I would spend a little time updating some of the 13F hedge fund portfolios since rebalance was last Friday.

The first three funds as well as the combo fund (FOF) I mentioned in my book The Ivy Portfolio.

All top 10 holdings YTD 2009 using AlphaClone:

Buffett: 18.6%

Blue Ridge: 16.9%

Greenlight: 19.1%

FOF (top 3 from each): 15.1%

World Beta Value Masters: 43.9%

S&P500: 11.0%

Since 2000, annualized:

Buffett: 7.8%

Blue Ridge: 6.7%

Greenlight: 11.4%

FOF (top 3 from each): 8.9%

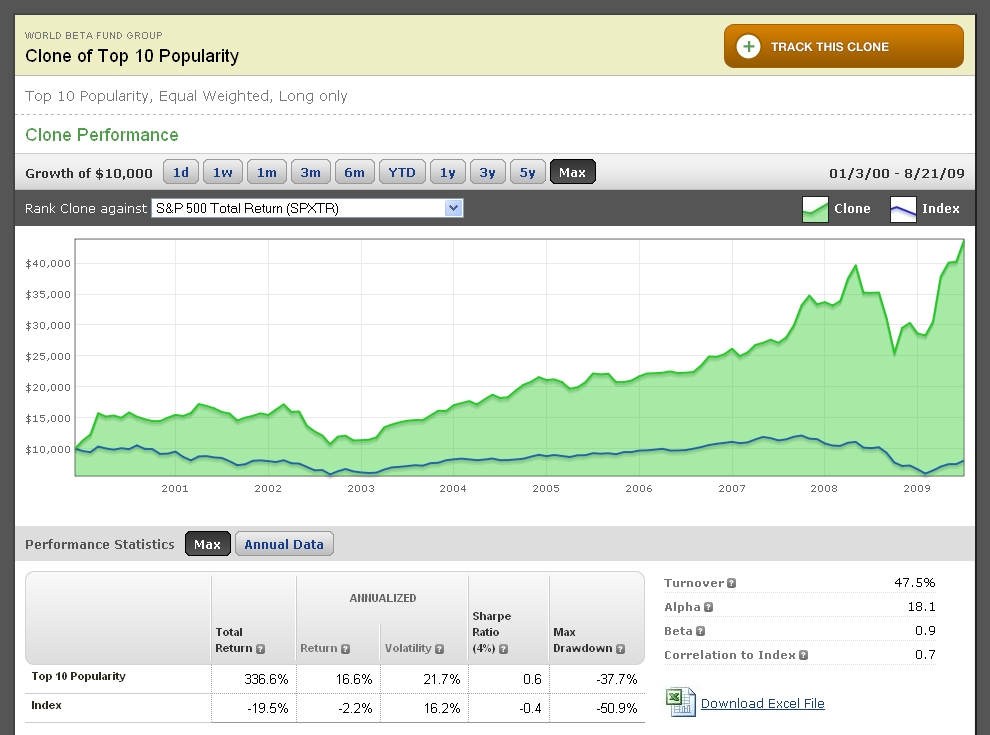

World Beta Value Masters: 16.6%

S&P500: -2.2%

That’s a lot of alpha! Below is an equity curve of the World Beta Value Masters that we have been tracking real time on the blog since the beginning of 2007. Hitting all-time new highs currently…and beating the S&P500 by over 20% a year since tracking in real time (’07). This includes a fund that imploded (Okumus).

New buys include Hewlett Packard (HPQ), Liberty Media (LMDIA), and Phillip Morris (PM).